This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.

The number of Q1-2020 funding rounds in the smart buildings space declined 27%, but there was an increase of 84% in transaction values compared to Q4-2019.

Venture capital financing is undoubtedly being impacted by COVID-19 but it is too early to say by how much. Quarterly data is volatile and investment is a lagging indicator - deals often take months to be completed.

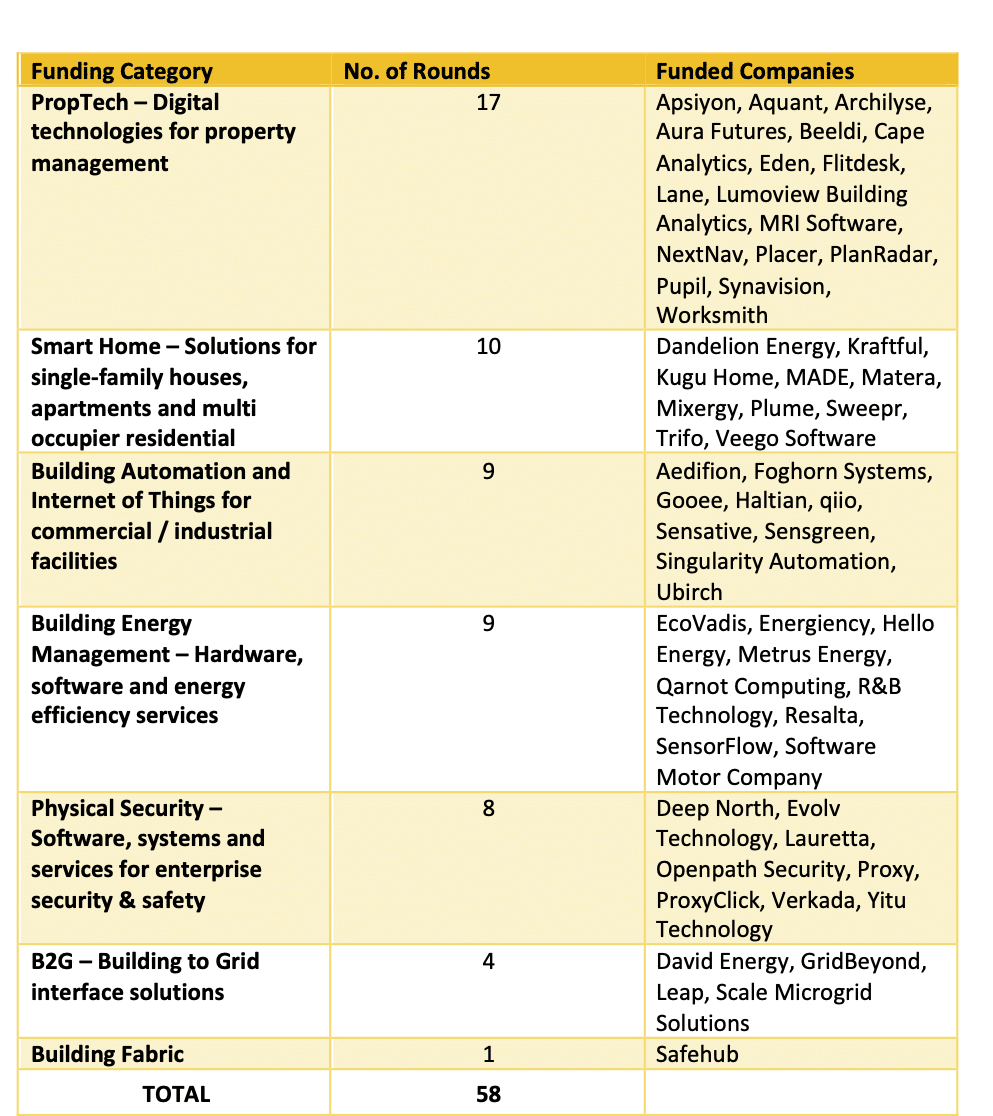

It is likely that in Q1 most deals were completed before the pandemic crisis took hold and the drop off in number of rounds from 79 to 58 is an indication that 2020 funding levels will be lower this year, returning to those seen prior to the last 2 exceptional years.

The total value of transactions increased, with deal values up 84% to $1.47 billion from $800 million in Q4-2019. This high deal value can be attributed to several project financing transactions, a number of later stage rounds (Series C and D) and private equity financing.

Table 1: Smart Building VC Investments in Q1 2020

Private equity transactions included:

- a $300 million investment by Warburg Pincus in Scale Microgrid Solutions. The company designs, builds, operates, and finances on-site distributed energy systems and microgrids for commercial and industrial facilities throughout North America.

- a $200 million investment by CVC Growth Partners in in EcoVadis SAS. The EcoVadis sustainability intelligence suite spans the full spectrum of sustainability risk and performance management with broad-scale supply chain risk screening and mapping, reliable scorecards with actionable ratings, and complete audit and improvement management.

The highest funded VC deals in the quarter were:

- NextNav, an innovator in 3D geolocation services, raised $120 million in debt and equity financing. NextNav has developed a platform that localizes smartphones vertically and indoors through MBS (Metropolitan Beacon System) technology. This makes it possible for rescue forces to identify the precise altitude or height position of people in buildings making an emergency call and to find them more quickly.

- Verkada, a San Mateo, CA based startup in cloud- based enterprise video security, secured $80 million in Series C financing at a $1.6 billion valuation. The funding comes from corporate investor, Siemens through its Next47 venture capital unit, Sequoia Capital, Meritech Capital and new investor Felicis Ventures. The company announced its entry into the $7 billion access control market with a new line of access control products, which will be integrated with its video surveillance offering.

- Smart Home Services provider, Plume closed a new financing round of $85 million. This includes $60 million in Series D preferred equity and $25 million in debt financing, bringing Plume's total equity funding to $127 million. Plume provides a Consumer Experience Management (CEM) platform as a cloud SaaS offering which has been adopted by over 30 leading communications service providers. With over 650 million devices communicating with 16 million OpenSync switches across 14 million households, Plume's cloud controller operates the largest software-defined network in the world. Created and open-sourced by Plume in 2018, the OpenSync framework is the fastest growing initiative of its kind that enables the curation, delivery of support and services, and management of devices throughout the smart home.

We anticipate that investment in smart buildings will continue to decline in the remaining quarters of 2020 as the full impact of the COVID-19 outbreak becomes evident.

Follow to get the Latest News & Analysis about the Competition in your Inbox!