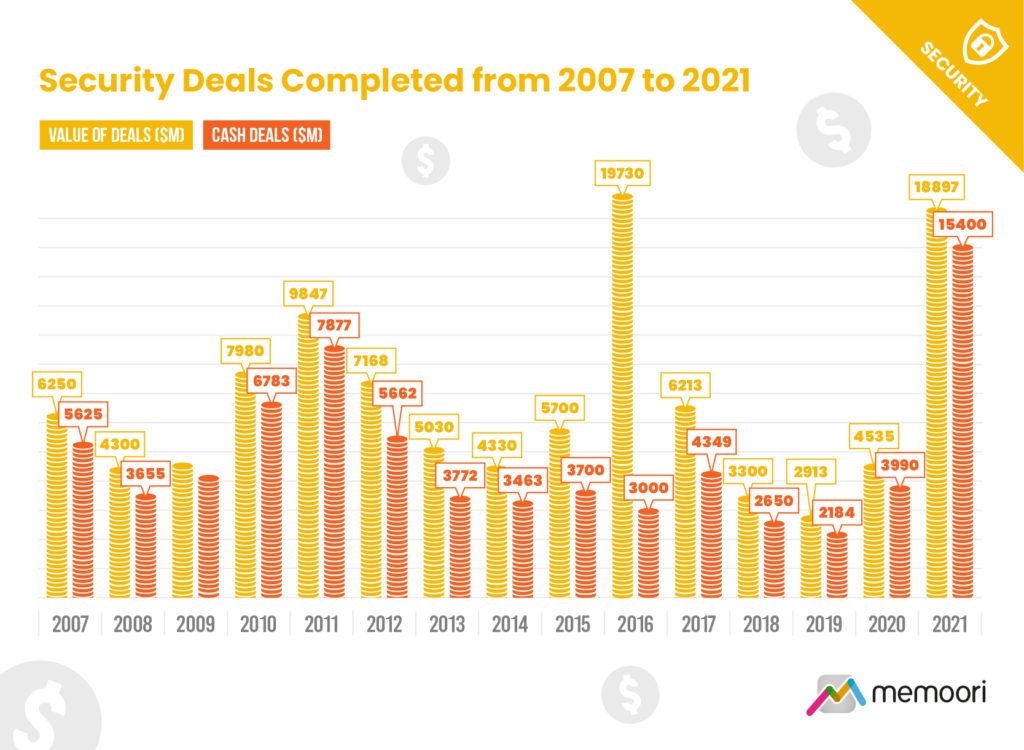

The total annual value of mergers and acquisitions (M&A) in the physical security industry over the last 15 years has been very volatile. In the peak years there was always at least one major acquisition, often two, with a value of between $2 billion and $16 billion, exaggerating the contrast with low-M&A trough years. While these peak years do not necessarily coincide with an increase of general trading figures, the extended trough years do reflect lower sales, as we have seen in recent years. 2021, however, bucked the declining trend with record breaking M&A value and a sharp increase in the number of deals.

“Over the last 8 years, external companies, excluding private equity organizations, lost their appetite for acquiring physical security companies and we have not registered any acquisitions from companies outside the security business, apart from Private Equity companies, in the last 3 years,” explains our physical security market report covering 2021-2026. “2021 bucks the trend of a steadily decreasing number of deals, and the trend towards lower total in terms of spending on acquisitions across the board.”

Over the last 15 years, the average annual total of all acquisitions was just under $6.3 billion and the average number of deals was 42. Over the last 4 years that average annual deal value dropped to $4.2 billion, with the average number of deals only 26. However, in 2021 our research identified total of 38 deals compared with only 20 last year, with a total value of $18.89 billion, making 2021 the second highest year on record in terms of total value, beaten out only by 2017, the year of the high-value Johnson Controls and Tyco merger.

Average deal value in 2021 was $510 million, which is amongst the highest on record and a stark contrast to the $168 million in 2018, $112 million in 2019 and $211 million in 2020.

Last year also came close to breaking the record for total value of deals completed, but the data has been somewhat skewed by two major deals, including the $5.3 Billion purchase of UK integrated security company G4S by Allied Universal, and the $8 Billion acquisition of FLIR by Teledyne. While the sharp increases vs recent years brings renewed optimism to the sector, a good 2021 alone does not entirely break the volatile trends we have seen over the past 15 years.

“2021 was distinct in that it featured a large number of cross border acquisition deals. Cross border deals accounted for 53% of the deals carried out this year, compared to only 40% in 2020 and only 23% of the deals carried out in 2019. In fact this is the highest rate of cross border deals we’ve noted over the last 6 years,” explains our in-depth report. “While many of the cross-border deals were related to the acquisition of new IP, many are indicative of a continued desire amongst vendors to extend their geographic coverage. Although five of the seven largest deals were led by US firms, in general deals were much more internationally distributed than in previous years.”

“While competition has heightened and profit margins have fallen, the physical security business has performed well when compared with other markets as a whole and the business still has plenty of room for further consolidation,” reads our report. “Most analysts in the business believe that it is still too fragmented and that consolidation will be needed to meet the challenge of commoditization. Some talk of the top ten companies taking a market share of 90% of the total market by 2025. We still think, based on current trends, that this remains unlikely, but Video Surveillance could well be dominated by no more than eight players by 2025.”

The video surveillance segment also saw significantly more deals than last year’s solitary deal, with strong evidence of more companies seeking AI expertise and intellectual property. Notable acquisitions such as French multinational IT major Atos’ purchase of Ipsotek and its AI analytics platform, and Agent Vi’s purchase of Swedish AI video analytics company Iristy. Access control also proved a popular segment, with private equity firm Triton Partners picking up ACRE, while Securitas expanded their global reach through the purchase of Stanley Security’s operations in several European and Asian nations, and Salto buying out Austrian electronic lock specialists Ganter Electronic.

“2021 saw a return to vibrant acquisition activity in the market, with most segments seeing at least one deal. This is perhaps surprising given the pandemic, but global M&A on the whole has been vibrant over the past 12 months, with volumes hitting record highs in Q3 2021 as companies and investors shaped their post-COVID future through transformative deals while their advisers struggled to cope with transaction volumes never seen before,” explains the new report. “The significant number of acquisitions from large firms not traditionally heavily embedded into the physical security market is also indicative of the rude health and growth prospects they forecast for elements of the market.”