This Research Note highlights our analysis of investment levels raised by smart buildings startups and established players in 2023 from venture capital firms, private equity and strategic investors.

We review investment in the smart buildings space in the context of the broader proptech sector, assess funding for startup companies, the role of corporate investors and provide our 2024 outlook.

Smart Buildings VC and PE Funding

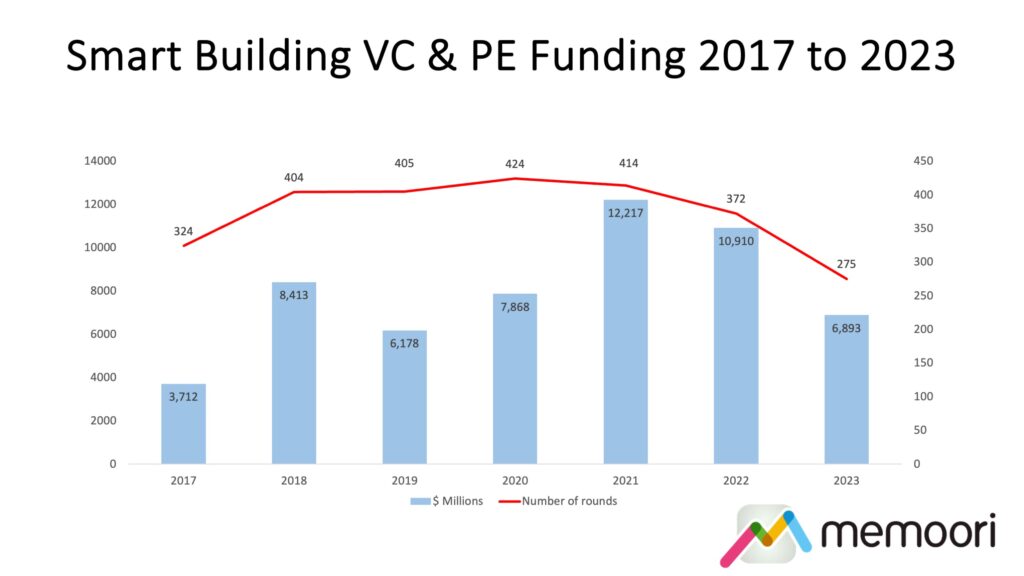

The smart buildings space witnessed significant growth in funding over the past 7 years, but 2023 marked a turning point with 37% less investment than a year earlier.

While investment continued at a relatively high level in 2022, a considerable decline in funding was evident in 2023, back to 2019 pre-pandemic levels in the context of a tightening investment landscape and a continuing economic slowdown.

Memoori recorded a 26% decrease in investment volumes, amounting to 275 funding rounds in 2023 compared to 372 in 2022 while investment values in the smart buildings space totaled $6.9 billion, a decrease of 37% in USD compared to 2022.

Note that Memoori’s overall definition of investments in the smart buildings space includes venture capital funding, private equity and strategic investments for both established players and startups in technologies for commercial and industrial real estate and smart homes.

Our definition focuses on the management and operational phase of the commercial and industrial building lifecycle and therefore excludes technology for the design, construction, purchase, financing, leasing and sale of real estate.

It was notable that investments in building energy efficiency, building-to-grid technologies, HVAC optimization, sustainability and ESG solutions enabled the smart buildings sector to avoid a steeper decline, which was seen in the proptech sector overall.

PropTech Sector Funding

According to the Center for Real Estate Technology & Innovation (CRETI) 2023 Proptech Venture Capital Report, proptech investments witnessed a significant decline in 2023, amounting to $11.38 billion.

This shift represented a 42.4% decrease from 2022’s $19.75 billion and indicates a more cautious approach by investors, due to market corrections or reassessment of long-term viability and impact of proptech ventures.

Funding for Startups

Funding for smart building startups (firms founded since 2013) accounted for 80% of total funding rounds in 2023, very similar to the number of new entrants obtaining funding in 2022 (81%). Our Startups Report series provides an overview of recent investments in the smart buildings space.

Memoori has tracked 217 funding rounds for startup companies, amounting to around $4.6 billion across the smart building sector in 2023.

Smart Buildings Corporate Investors

A diverse range of stakeholders - commercial real estate service firms, building owners and operators, vendors of building automation systems and HVAC equipment firms - have continued to fund startups. Corporate investors accounted for around 25% of the financial backers in the smart buildings space in 2023.

Strategic investments from corporate stakeholders in the built environment have contributed to a maturing smart buildings space.

This funding is often accompanied by partnership agreements enabling investors to apply the technology in their own business and property portfolios, allowing the various participants to more easily assess the outcomes and benefits of particular solutions and business models.

2024 Outlook

Looking ahead, despite the downturn in funding and current economic realities, we are confident that technology investment will remain a key driver for digital transformation of commercial real estate, as innovation continues to enable smarter buildings, aligned with global sustainability goals, more stringent regulations and the increasing demand for flexible user-centric property solutions.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.