We have published a brand new report on Access Control, Intruder Alarm & Video Surveillance in 2018, forecasting to 2023; which brings together all the factors that are influencing the future of the security industry.

The total value of world production of Physical Security products at factory gate prices in 2018 was approx. $31.55Bn, and the market is forecast to reach $51.38Bn by 2023.

We estimate that China accounts for approx. 31% of the worlds physical security business. It is now the biggest single country market for physical security products having increased its share by almost 50% in the last 7 years. Video surveillance equipment has been the major contributor here, with the market growing rapidly through a boom in new construction and safe city projects in the public sector.

However very little of this vast expanding market has been of benefit to western manufacturers as they have failed to establish a solid business base and significant market share in China. Whilst 2 Chinese manufacturers, HIKvision & Dahua now have sales of more than $5 billion between them and the kind of scale that allows them to reduce prices to levels most western manufacturers can’t compete against.

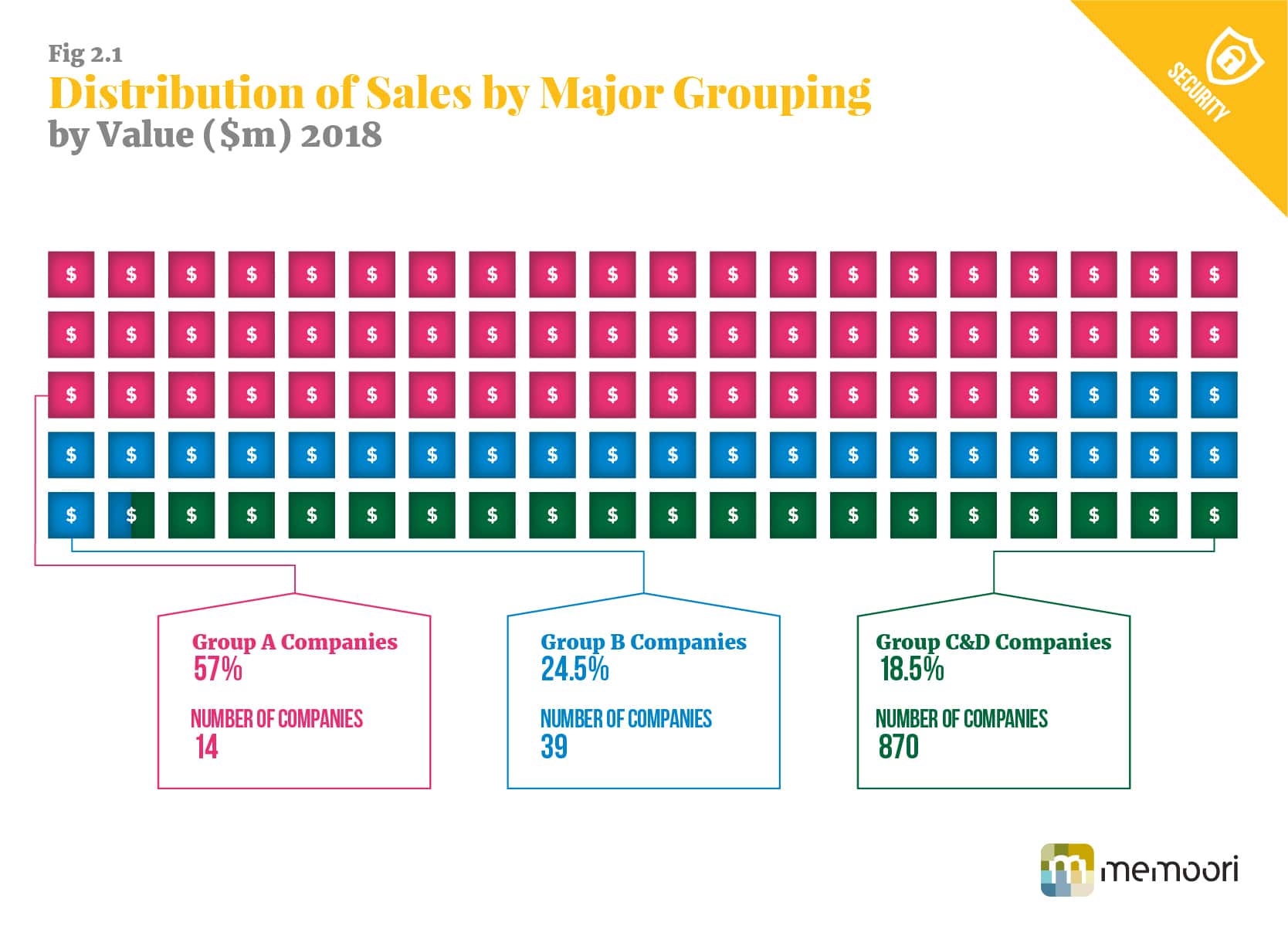

There are now 14 companies, with physical security product revenue over $1Bn (we term Group A Companies) accounting for some $18bn in 2018. Hikvision, Dahua and Axis Communications has given new impetus to this group and the merger between Thales and Gemalto has produced a new mega Identity Management / Biometrics company. The net effect is that this group has significantly increased its contribution and the average sales revenue is over $1.2bn giving them 57% share of the physical security product market.

Access Control is still a much smaller business than Video Surveillance and today less competitive, but consolidation is creating a more competitive environment and with it comes the confidence to move forward and take up the challenge of embracing new technologies that will deliver better performing products. However if manufactures prefer to continue to be insular and proprietary, it will not be good news for continued growth, for traditional proprietary systems mean limited options for the customer and restricted possibilities for integration and scalability.

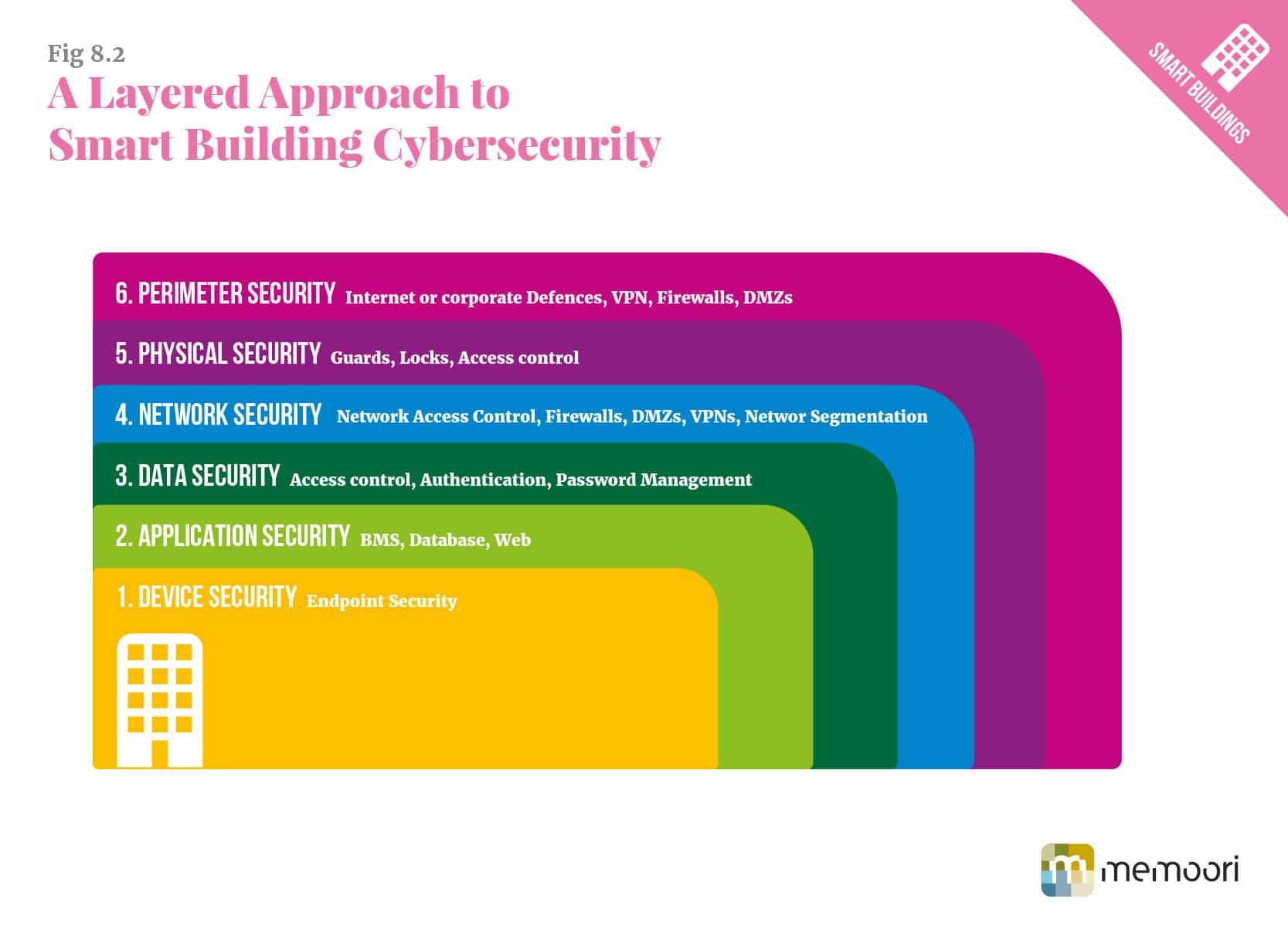

2018 is the year that all the stakeholders in the Physical Security Industry finally got the message that the Cyber Security threat was capable of causing significant harm to their businesses. Now one of the critical buying propositions of physical security is “What have you done to make this equipment less vulnerable to cyber attack”? The owners and operators of buildings, particularly those having large building estates need to know that manufacturers and installers fully understand what needs to be done to reduce vulnerability and make sure it is applied to their equipment and systems.

The report also shows that in 2018, mergers and acquisition activity in Physical Security totalled $7.33Bn (16% up on 2017), which looks like the start of a new wave of growth. The structure of the industry is still very fragmented with hundreds of small companies finding it increasingly difficult to compete and it looks inevitable that the general trend line of value and volume of mergers and acquisitions will continue upwards over the next 5 years, but at a modest growth rate.

The average value of a deal increased from $100m in 2010 to $150 million in 2015. This year (2018), adjusting for the non-Physical Security business of the Gemalto acquisition the average deal was around $160 million.

The number of deals in the range of $50m to $150 has increased and there has been more diversity across the different product types. Cross border acquisition accounted for 24% of the deals carried out this year. For the most part over the past 5 year period the main driver has been the need to extend geographic coverage but this year acquisition of technology has been the main objective. Some 62% of the deals involved the acquisition of US companies with the vast majority being domestic affairs.

About the Report

At 329 pages with 43 charts & tables & ONLY $1,750 USD for a single user license, The Physical Security Business 2018 to 2023; Access Control, Intruder Alarm & Video Surveillance report filters out all the important conclusions, supported by facts, to demonstrate what is shaping the future of the security industry. For more information, visit; https://memoori.com/portfolio/the-physical-security-business-2018-to-2023