This Research Note examines two businesses within JLL which offer technical operations and maintenance (O&M) solutions and services for commercial real estate – JLL Workplace Management and JLL Technologies. This article is based on JLL’s 2022 Annual Report, their 2022 investor briefing and transcript and previous Memoori analysis on the company’s technology strategy in the smart commercial buildings space.

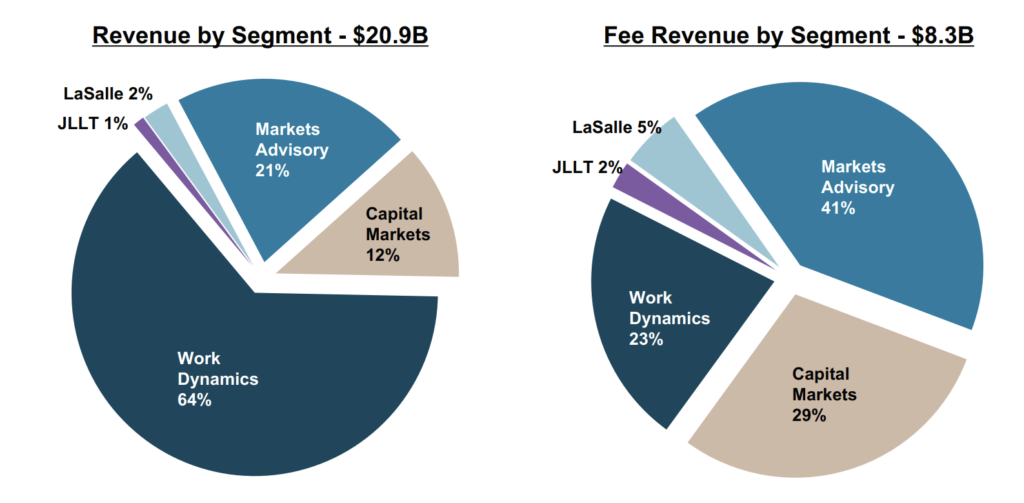

JLL is one of the largest real estate service providers in the world, with 2022 consolidated revenue of $20.9 billion (+11% versus prior year) and fee revenue rising 7% year-on-year to $8.3 billion. The group has operations in over 80 countries and a global workforce of more than 103,000.

JLL Workplace Management (WPM)

JLL Workplace Management business, one of 3 divisions in the Work Dynamics segment, provides comprehensive facility management services globally to corporations and institutions that outsource the management of the real estate they occupy, typically those with large multi-market portfolios of over one million square feet.

The WPM offering leverages tech-enabled solutions and focuses on the work, worker and workplace to help clients manage costs, achieve sustainability goals, improve workplace service delivery and enhance end-user experience and performance.

Facilities under management cover all real estate asset classes, including corporate headquarters, distribution facilities, hospitals, research & development facilities, data centers and industrial complexes. As of December 31, 2022, WPM managed approximately 1.6 billion square feet of real estate for their clients.

JLL Workplace Management reported an 18% growth in fee revenues to $752.8 million, driven by new client wins and the expansion of existing global mandates, most notably in the United States.

JLL Technologies

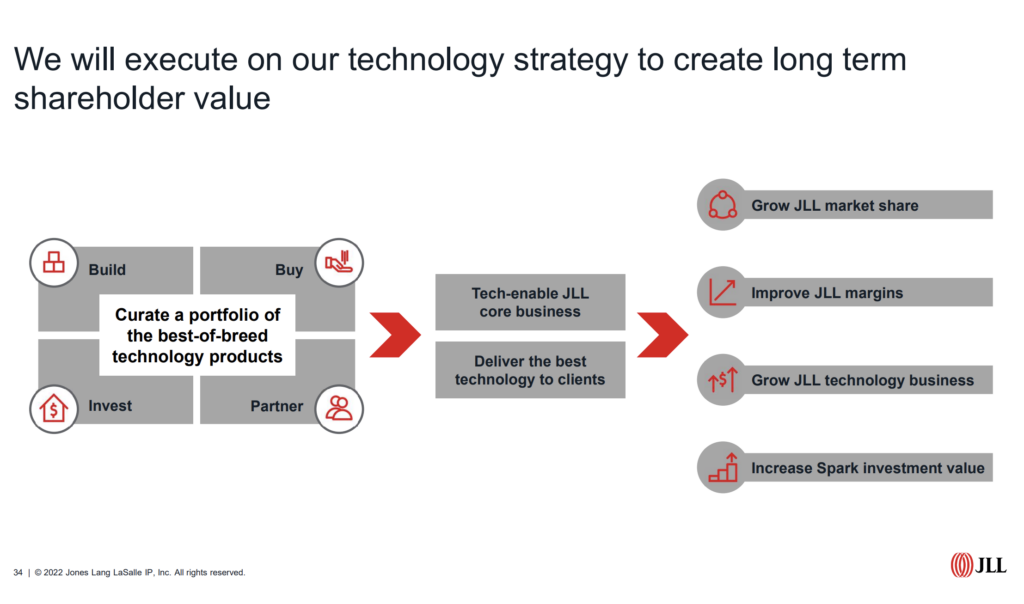

JLL Technologies is focused on curating an industry-leading technology portfolio to tech-enable JLL and their clients by innovating and building technology solutions internally as well as by partnering with, investing in, or selectively acquiring market-leading PropTech companies.

Examples include:

- Acquired Building Engines in November 2021 for $300 million, a building operations platform transforming how properties are run, optimizing experiences for operators and tenants, and improving profitability across CRE portfolios. Building Engines platform is deployed in over 4 billion square feet.

- Acquired and built Corrigo, a mobile and desktop-integrated product that enables facility managers to efficiently manage work orders, centralize repairs and maintenance, and automate tasks, all on a scalable level. Over 75% of Work Dynamics clients adopt Corrigo.

- Acquired Hank in January 2022, a technology which uses machine learning and artificial intelligence to optimize building energy efficiency, maintenance costs and tenant comfort, facilitating improved property operating income.

- Acquired Envio in July 2022, a Berlin-based company with hardware and software which optimizes building energy efficiency.

- Invested in Infogrid sensor technology to provide dynamic cleaning services for Work Dynamics clients. The occupancy-based service generates a 15% operating efficiency in facilities management.

- Invested in and partnered with HqO, a tenant experience product which JLL resells and is currently bundling with Building Engines to bring this combined tech stack to market to their occupier clients. HqO is deployed in over 7,500 companies.

- Invested at early seed stage and partnered with Vergesense, an occupancy sensor solution, which JLL also resells. Their technology is deployed in over 600 million square feet.

- Invested in and partnered with Saltmine, which offers workplace strategy, design, and optimization cloud-based software that allows corporate real estate teams to plan workplaces and test-fit new layouts and space designs digitally. In addition to its capital investment, JLL workplace has entered into an agreement to sell Saltmine's software directly to its customers, creating a powerful distribution channel for Saltmine's innovative platform.

JLL Spark, the corporate venture capital arm of JLL Technologies, has invested more than $380 million in more than 45 early-stage PropTech startups, as of November 2022.

JLL Technologies revenues in 2022 was $213.9 million, a 30% increase on 2021 revenue of $166.2 million. Fee revenue was $200.2 million, +47% versus $137.2 million in 2021. JLL Technologies top-line growth included $32.3 million from acquisitions closed in late 2021. Organic fee revenue increased 23% for the year, driven by new customers as well as growth from existing customers in software and solutions offerings.

JLL Technologies forecasts $500 million of fee revenues, with a 20%+ CAGR and bottom-line profitability by 2027.

With this approach, JLL has differentiated itself from other real estate service firms. With 78% of their occupier and investor client base anticipating further investment in PropTech by 2025, JLL are a strong competitor for facilities management firms, workplace software companies and BMS vendors in the commercial smart buildings market.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.