Learnd, a UK-based systems integrator, has announced the acquisition of Complete Energy Controls, a Scottish firm delivering Building Management Systems (BMS) with a multi-site energy management focus.

This Research Note highlights the public listing of Learnd, their “buy and build” business model, recent and forthcoming acquisitions, based on investor presentations, SPAC documents and Memoori analysis.

In September 2022, GFJ ESG Acquisition I SE, a SPAC listing on the Frankfurt Stock Exchange, entered into a definitive business combination agreement with Learnd Limited. The acquisition of GFJ ESG Acquisition was completed in a reverse merger transaction on 23rd January, 2023. The transaction valued Learnd at a pre-money equity value of EUR 99 million (US $99 million).

Memoori noted in October 2022 that GFG had previously been a contender for a SPAC acquisition of tado, the smart thermostat company, but this deal failed to complete.

Founded in 2020, Learnd supports customers in making energy savings and reducing their carbon emissions. They claim to manage one in 20 large non-residential buildings across the UK. Learnd’s “buy and build” business model is focused on acquiring profitable companies that have strong delivery capabilities and long-standing customer relationships.

They then intend to increase the profitability of these companies through their integration approach and by upselling proprietary platform technology to reduce energy consumption, undertake load management and provide demand response services to the acquired client base.

The acquisition of Complete Energy Controls brings a number of buildings in sectors such as Healthcare, Retail, Government, Leisure and Commercial – adding significant energy capacity upon which Learnd technology can be deployed.

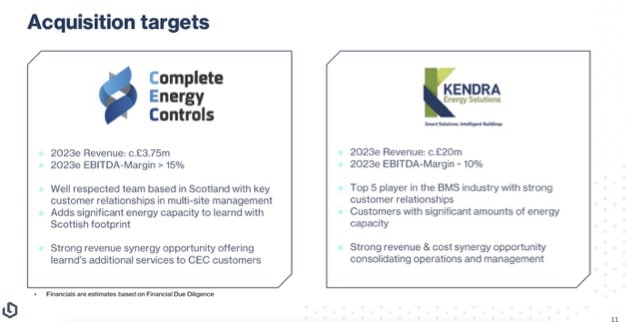

Learnd’s Investor presentation of April 2023 identified two target acquisitions, as the company have also signed a Letter of Intent to acquire Kendra Energy Solutions, a leading BMS player in the UK, with estimated 2023 revenues of around GBP20 million.

This acquisition, if completed, would more than double Learnd revenues in 2023. Their 2022 revenues are currently estimated at more than €30 million, forecasted to rise to €100 million euro in 2023 and around €300 million in 2026.

The Learnd group has completed three acquisitions and one divestment since it was founded in Jan 2020:

- WEMS, a Manchester, UK-based manufacturer of a wireless building energy management system.

- Aimteq, a UK firm specialising in the installation, maintenance & monitoring of BMS and BEMS equipment.

- Comfort Controls, a systems integrator based in the south east of England.

- Allied Lifts was divested in 2022.

Reporting a strong pipeline of further acquisitions in Continental Europe, the company has ambitious goals for revenue growth and high-margin service business, facing some strong competition from independent systems integrators such as Nordomatic and established BMS manufacturers, such as Siemens.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.