Our new report “The Physical Security Business in 2013” shows that M&A activity in the Security Industry has grown by a compound annual rate of 7% over the last 14 years but during this time it has peaked and declined 4 times culminating with its value decreasing by 48% during the last 2 years. External forces have influenced this cyclical pattern but in the last 2 years internal consolidation matters have had more impact.

With this drop of 48%, the value of merger and acquisition deals in 2013 was approximately $5.0 billion. We identified 34 deals in 2013 compared with 56 in 2012. Whilst the number of deals and total value of acquisitions has fallen the average value of a deal has actually increased from $120m in 2011 to $147 million in 2013.

There are 3 main reasons for this. The first is that the industry underwent a major restructuring during the period 2009 to 2011 and in the last 2 years has paused to consolidate that process. The second is the lack of confidence and/or interest by the major conglomerates to commit more investment to the industry. The third reason is that there has been a lack of buyers from outside the business, particularly Defense and IT.

The positive news is that acquisition activity in the middle market, mainly populated by specialist security companies has significantly increased. 2013 has been a good year for acquisitions, irrespective of the fact that by volume and value it has declined; because we now have medium and small market players taking a more active role. Through this, the industry structure is becoming more effective in delivering customer value propositions.

Forecast of M&A Business to 2017

Memoori forecasts that M&A activity will grow at a CAGR of 8% over the next 5 years to 2017. This assumes that the European debt crisis will find a long term solution and at least stabilize the EEC economy but not provide any growth until the last quarter of 2013, whist the US will grow at around 2% and emerging markets will maintain their 2012 performance. That said, deal activity did slow down in September and the first half of October and although market sentiment appears to have temporarily cooled, we are forecasting an increase of 5.5% in M&A activity in 2014.

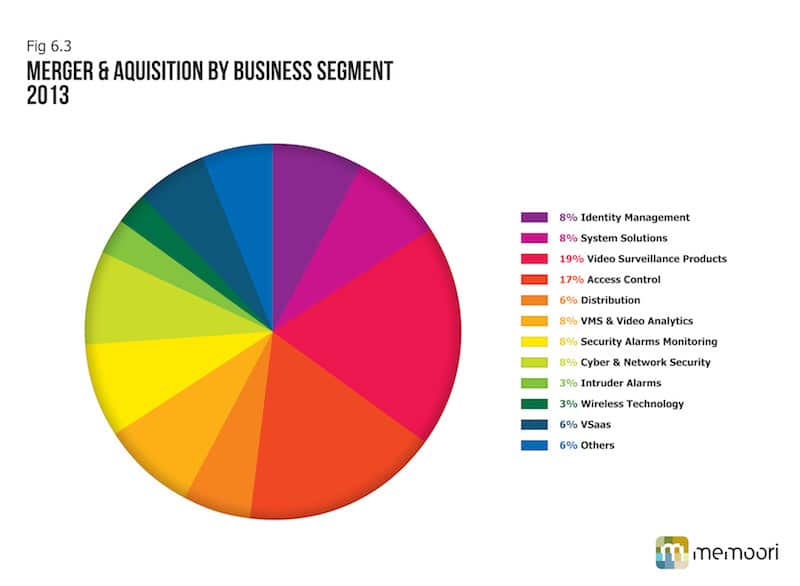

M&A Analyzed by Business Segment

The breakdown of acquisition spend in 2013 in 12 business categories shows that Video Surveillance Products had the highest share by number with approximately 19%. Access Control had the next largest share at 16%. Identity Management, Systems Solutions, VMS and Video Analytics, Security Alarms Monitoring in residential and small commercial premises and Cyber and Network Security all took 8%. This year we included VSaaS for the first time and it achieved a 6% share. We expect this to grow next year.

The integration of Identity Management, Authorization and Access Control has given rise to a number of major acquisitions in the last 3 years. Back in September 2010 there was a flurry of activity with the purchase of L-1 Identity Solutions by Safran for $1.1 billion and 3M’s purchase of Cogent Systems for $430m. In 2013 whilst the number of deals declined, this group accounted for 25% of all acquisition value.

A very significant number of acquisitions in this area have been made by powerful IT based companies. All of these deals were intended to build platforms that will facilitate the convergence of some aspect of security with the business enterprise.

The demand for acquiring Access Control suppliers has more than doubled in 2013 but almost all of these have been strategic buys by physical security companies. Notable acquisitions this year included Avigilon’s acquisition of RedCloud Security and Vanderbilt’s buy of Schlage Security Mangement Software and Dorma’s purchase of Rutherford Controls Inc.

Strategic Buys Dominate Whilst IPO’s & MBO’s Disappoint

Strategic buys have been the dominant force for acquisitions in the last 4 years and this is unlikely to change in the near future despite the fact that Private Equity and Venture Capital companies may become more active in the security business.

IPO’s of relative new start companies have been conspicuous by their absence, partly because few have grown fast enough to command a satisfactory valuation for their investors and they are holding off until market conditions & valuations improve.

The notable exception to this was Avigilon’s successful IPO in November 2012. Since debuting on the Toronto Stock Exchange at C$4.50, their stock rose 89 percent to trade at C$8.49 in a matter of days, giving it a market value of C$304.6 million. A year later the stock is trading at C$19.75. That’s the biggest gain in the past year for companies that began trading in Canada with an offering of C$20 million or more.

Our report “The Physical Security Business in 2013” is a definitive resource for Security Market Research & Investment Analysis. For more details, please visit - http://memoori.com/portfolio/the-physical-security-business-in-2013/