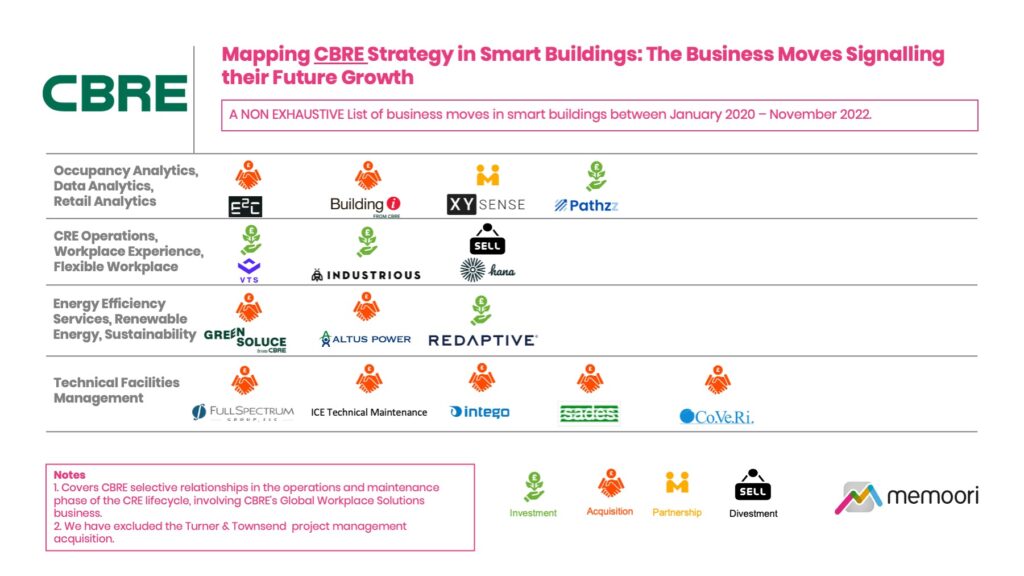

This Research Note examines the emerging strategic priorities of CBRE Global Workplace Solutions (GWS) in the smart commercial buildings space. We have mapped M&A, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the business, by categorizing the various business relationships by technology and investment type over a 3-year period between January 2020 and November 2022.

CBRE Group Inc, a Fortune 500 and S&P 500 company headquartered in Dallas, is the world’s largest commercial real estate services and investment firm. CBRE Global Workplace Solutions (GWS) business, acquired from Johnson Controls in 2015, provides a broad suite of integrated, contractually based outsourcing facilities management services to occupiers of real estate. As of December 31, 2021, GWS facilities management revenues (excluding project management) amounted to $4.8 billion, achieved through managing approximately 4.4 billion square feet of facilities.

Our strategy mapping exercise highlights 9 acquisitions, 1 partnership, 1 divestment and 4 venture capital investments of relevance over the last three years.

The commentary below highlights some of the recent investments and partnerships in occupancy and data analytics, commercial real estate operations, energy efficiency services and technical facilities management.

Data Analytics, Occupancy Analytics, CBRE Retail Analytics

In November 2022, XY Sense, an Australian startup providing an occupancy sensor and analytics platform for corporate real estate teams, won the CBRE Innovation of the Year Award. XY Sense's sensor technology is installed at CBRE’s flagship Henrietta House in London, UK to optimize the workplace experience for their people. As a result, they have been able to monitor real-time occupancy and utilization patterns, enabling effective decisions.

In August 2022, CBRE Group announced the acquisition of E2C Technology, an Artificial Intelligence data-driven technology company that enhances its facilities management service offering. CBRE already utilizes E2C’s cloud-based Nexus solution in its Smart Facilities Management solutions for rapid onboarding of commercial buildings based on AI/ML models for data ingestion, aggregation, and normalization.

In January 2022, CBRE Group acquired Buildingi, a provider of occupancy planning and technology services, to meet growing occupier demand for occupancy management services by combining CBRE’s occupancy management expertise with Buildingi’s technology across CAD, Integrated Workplace Management Systems and Building Information Modeling.

In November 2021, CBRE made a strategic equity investment in Pathzz, an Australian retail analytics startup founded in 2020. Pathzz’s customer analytics product applies advanced Artificial Intelligence and Big Data processing to a stream of mobility signals and other descriptive data sets to help inform property decision-making. The startup provides insights on consumer profiles, shopping habits and demographics, allowing clients to create rich profiles on the type and volume of people who visit any location and map how these trends change over time.

Commercial Real Estate Operations, Workplace Experience

In September 2022, CBRE led VTS‘s latest funding round, providing $100 million of the $125 million that the rapidly expanding, multi-product proptech business raised. VTS has grown significantly from its early days as a leasing operations tool. In recent years, it has added products for tenant experience and building operations to its platform, strengthening its foothold in the workplace management space. In addition to its capital investment, CBRE will partner with VTS to roll out the VTS Platform as the technology platform of choice for its agency leasing and property management teams starting in the U.S.

In May 2022, CBRE invested a further $100 million in Industrious, a provider of premium flexible workplace solutions. Following a previous investment in 2021, CBRE has acquired a significant minority interest (40%) in the company, based on its belief in Industrious’ ability to capture a growing share of the rapidly expanding market for flexible office space. CBRE has also transferred its own flexible workspace brand Hana - which operates 10 locations in the US and UK - to Industrious as part of the transaction.

Energy Efficiency, Renewable Energy, Sustainability

In June 2022, CBRE acquired Green Soluce SAS, which enhanced its environmental, social and governance (ESG) advisory services capabilities in France and Continental Europe.

In December 2021, CBRE Acquisition Holdings concluded a $1.5 billion merger with Altus Power, Inc., a leading provider of solar energy for commercial and industrial properties.

In October 2020, CBRE participated in a $156.5 million funding round for Redaptive, a provider of Efficiency-as-a-Service solutions for commercial and industrial customers. This deal follows on from a strategic investment in Redaptive in April 2018.

Technical Facilities Management Services

Strategic in-fill acquisitions have also played a key role in strengthening GWS service offerings. The companies they have acquired in the last three years have been regional or speciality firms that augment their regional presence and complement their existing platform. In November 2022, CBRE acquired US-based Full Spectrum Group for $110M, complementing its existing global Integrated Laboratory Solutions capabilities for occupier clients in the fast-growing life sciences sector.

In Australia, ICE Technical Maintenance Services (ICE), a provider of commercial property facilities and technical maintenance services based in Sydney enhances CBRE’s specialization in engineering and technical services in the Pacific region. While in Europe, facilities management firms in Denmark (Intego), Spain (SADES) and Italy (Coveri) were acquired.

This mapping exercise confirms the CBRE focus on strategic acquisitions which they believe can significantly decrease the cost, time and resources necessary to attain a meaningful competitive position within targeted markets or business lines.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.