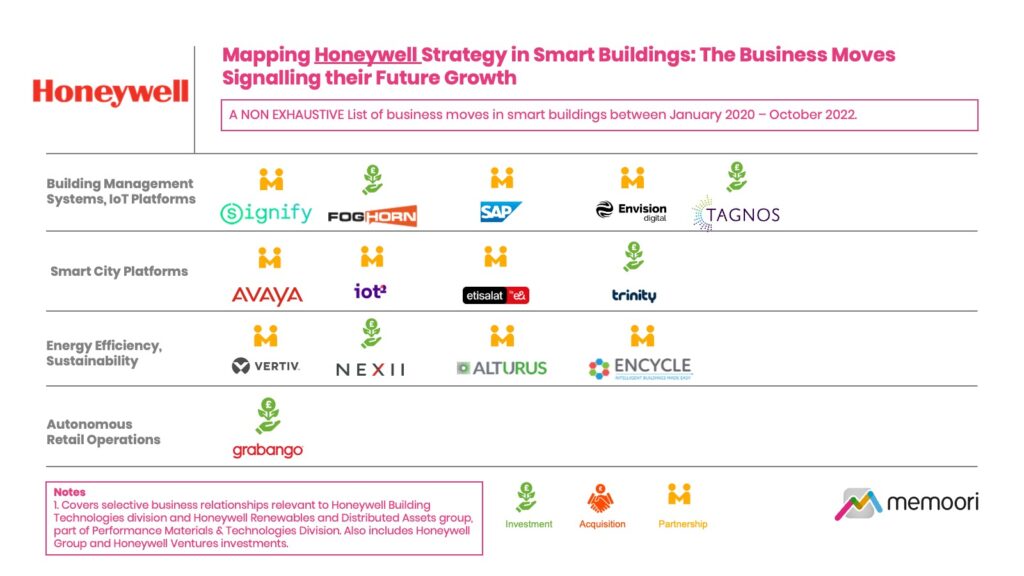

This Research Note examines the emerging strategic priorities of Honeywell in the smart commercial buildings space. We have mapped M&A, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the company, by categorizing the various business relationships by technology and investment type over a 3-year period. This article, Part 1 of a 2-part analysis, is intended as a non-exhaustive indicator of the strategic direction of Honeywell Building Technologies between January 2020 and October 2022.

Honeywell Building Technologies with $5.5 billion revenues in 2021 is one of the top three global providers of building management systems, control products and energy management solutions and services. The business also offers a broad portfolio of fire, life safety and security systems. Their products, software and technologies are found in more than 10 million buildings worldwide.

Our strategy mapping exercise highlights 16 partnerships, 3 acquisitions and 9 venture capital investments of relevance over the last three years.

The commentary below highlights the key investments and partnerships in BMS, IoT Platforms, Smart City Platforms, Energy Efficiency and Autonomous Retail Operations.

Building Management Systems, IoT Platforms

A significant partnership was announced in December 2020 when Honeywell and Signify announced a strategic alliance to deploy integrated, smart lighting solutions for commercial buildings. The collaboration integrates Signify’s Interact connected lighting system and software, and its UV-C disinfection lighting, with Honeywell Building Management Systems and the Honeywell Forge enterprise performance management platform. The combined offerings manage energy consumption while factoring in occupancy along with air quality indicators such as temperature and humidity.

Jointly developed with SAP on the SAP Business Technology Platform, Honeywell announced the launch of a cloud-based solution, Honeywell Forge Real Estate Operations, which extends the capabilities of Honeywell Forge enterprise performance management software. The SaaS solution aggregates the financial, employee and real estate data of SAP with Honeywell's buildings data, IoT sensor data and building management system insights.

In December 2020, Envision Digital International Pte Ltd, a decarbonisation and Artificial Intelligence of Things (AIoT) technology company and Tridium Inc., a Honeywell subsidiary, entered into a strategic agreement to develop joint innovations. Envision Digital will combine its expertise in smart energy management (solar, wind and storage) and AIoT optimisation and controls with Tridium's expertise in digital services for smart parks and smart building management.

In February 2020, Honeywell Ventures participated in the $25m Series C funding round of Foghorn, a developer of intelligence edge computing software. Saudi Aramco Energy Ventures, GE Ventures and Robert Bosch Venture Capital and others also particapted in the round. However, in January 2022, Foghorn was acquired by Honeywell's competitor Johnson Controls.

In May 2020, Honeywell Ventures participated in a funding round for Tagnos, a developer of workflow orchestration software for hospital operations. TAGNOS' Enterprise 4.0 solutions provide real-time insights and communication by tracking patients, staff, assets and their interactions. With integration into the electronic health record (EHR) systems, hospital IT systems and communication platforms, TAGNOS brings real-time intelligence and prescriptive actions based on data analytics.

Smart City Platforms

Several strategic partnerships in 2022 reinforce Honeywell’s strategy to expand deployments of the Honeywell City Suite across the Middle East - with Avaya, ioT-squared and Etisalat.

In November 2020, Honeywell announced a strategic investment in Trinity Mobility Private Limited, an India-based software company and provider of Internet of Things (IoT) Smart Cities platform and software applications. The strategic investment was to allow Honeywell to expand its smart cities capabilities by providing access to Trinity's Smart City solutions, which integrate information from various systems across a city in a common interface and allow operators to better assess, operate and manage the city's connected infrastructure.

Energy Efficiency, Sustainability

A partnership with Nexii Building Solutions was announced in July 2021 to integrate the Honeywell Small and Medium Building Administrator powered by Honeywell Forge into new sustainable buildings constructed by Nexii. Honeywell will also provide its fire and security systems to support Nexii-constructed buildings.

In June 2021, Honeywell and Alturus announced a partnership to deploy battery energy storage systems to customers globally. Alturus will provide dedicated capital and structuring for Honeywell’s Renewables & Distributed Assets projects deployed for the commercial and industrial markets under an Energy Storage as a Service model.

Autonomous Retail Operations

In June 2021, Honeywell Ventures participated in a $39 million Series B funding round for Grabango, a US startup providing checkout-free technology for existing grocery and convenience stores. This was a strategic investment by Honeywell’s corporate venture capital arm, advancing its interest in autonomous solutions which can be retrofitted into existing stores.

Part 2 of this Research Note will examine the emerging strategic priorities of Honeywell in the Cyber Security, Physical Security, Life Safety and Emergency Response sectors.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.