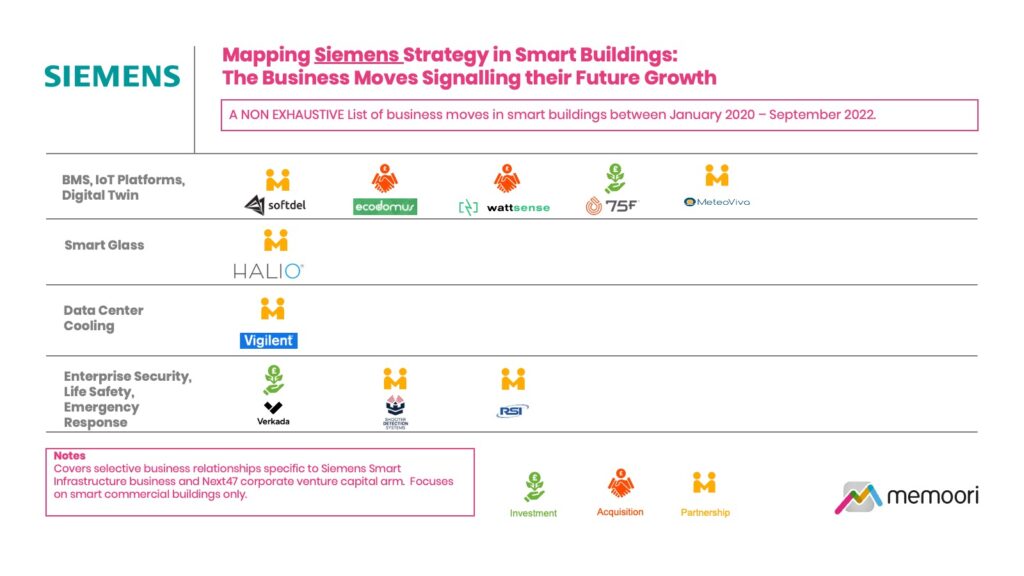

This Research Note examines the emerging strategic priorities of Siemens in the smart commercial buildings space. We have mapped acquisitions, mergers, strategic partnerships and investment activity to ascertain the growth ambitions of the Siemens Smart Infrastructure division; categorizing the various business relationships by technology and investment type over a 3-year period. This article, part 2 of a 2-part analysis, is intended as a non-exhaustive indicator of Siemens’ strategic direction between January 2020 and September 2022. Part 1 can be found here.

Our strategy mapping exercise highlights 16 partnerships, 3 acquisitions, 1 merger and 3 venture capital investments of relevance over the last three years. The commentary below highlights some of the key investments and partnerships in Building Management Systems, IoT platforms and Physical Security sectors.

Building Management Systems, IoT Platforms, Digital Twin

The Buildings business undertook two acquisitions in the BMS, IoT and Digital Twin sectors. Siemens completed an M&A deal in October 2021, with the bolt-on acquisition of French startup Wattsense, a hardware and software company which offers an innovative, plug-and-play IoT management system for small and mid-size buildings, expanding Siemens’ building products portfolio. Their IoT solution enables the adoption of energy management practices in facilities with little or no building management system technology.

EcoDomus, a small US provider of BIM-based digital twin software for buildings, was acquired in December 2021. This move enables the leading building technologies player to expand its cloud-based building operations twin software and its flagship building management platform Desigo CC. Building owners and occupants can generate digital replicas of their buildings and assets, creating a common data environment that integrates BIM, Building Management Systems (BMS), Computerized Maintenance Management Systems (CMMS) and Internet of Things (IoT) systems.

Another indication of Siemens’ focus on the under-served small and medium-sized buildings market is its participation in the Series A funding round of 75F, the developer of an IoT-based building management system. The startup has partnered with J2 Innovations, the developer of the FIN (Fluid Integration) software framework for building automation and IoT, acquired by Siemens in 2018. J2 and 75F aim to increase the proliferation of plug-and-play, IoT-based building automation offerings in order to decrease the energy footprint of buildings. 75F will complement its out-of-the-box building management system with J2's FIN Framework to improve its capabilities in third-party system integration and HVAC plant management.

Certified partners in the Xcelerator ecosystem include both startups and large firms in the smart building's landscape, many of which are existing members of Siemens Connect ecosystem.

The latest partner to join Siemens Connect Ecosystem, the US network for the Desigo CC platform is Softdel. Softdel's EdificeEdge IoT gateway platform connects to IoT devices and wireless sensors ranging from temperature, humidity, air quality, fire & smoke, lighting in building areas and at the same time integrates with Siemens' platforms.

Other partners include Halio, the manufacturer of smart-tinting glass. By integrating Halio into Siemens’ building management systems, facility managers gain a further tool to optimize building performance. Halio glass reduces HVAC costs while maximizing the use of natural light to deliver enhanced occupant comfort.

Data Center Cooling

Vigilent, a US provider of data centre energy optimization solutions, announced in July 2022 that it had joined the Siemens Xcelerator ecosystem. To improve the way cooling is distributed throughout data centre “white space,” Siemens has integrated Vigilent’s artificial intelligence-based dynamic cooling management solution into its data centre portfolio. Siemens strengthened its strategic partnership with Vigilent by becoming a minority shareholder in May 2018.

Enterprise Security, Life Safety, Emergency Response

Four investments in Verkada, a US startup offering cloud-managed enterprise building security and management software, were completed by next47 between April 2018 and September 2022. There has been negative publicity surrounding the company concerning its alleged doubtful business practices and harassment of female employees. Their cyber security breach in March 2021 was likely to have been of considerable concern, as hackers gained access to over 150,000 cameras, as our recent Cyber Security report highlights. But none of these incidents has deterred the venture capital arm of Siemens from continuing to invest.

In December 2021, Siemens and Shooter Detection Systems (SDS), an Alarm.com company, announced a partnership to integrate technologies to improve public safety in the event of an active shooter situation. The integration between the Guardian Indoor Active Shooter Detection System and Siemens Siveillance Video system (with the possible inclusion of Desigo CC building management system or Cerberus danger management system) software will enable organizations to automatically alert building security by triggering alarms, associate live video feeds with real-time tracking of identified shots on building floorplans, and take other automated actions when gunfire is detected within a building.

These acquisitions, investments and technology partnerships reinforce Siemens Smart Infrastructure’s previous commitment to double its digital revenues from EUR 700 million in FY2021 to EUR 1.5 billion by 2025.