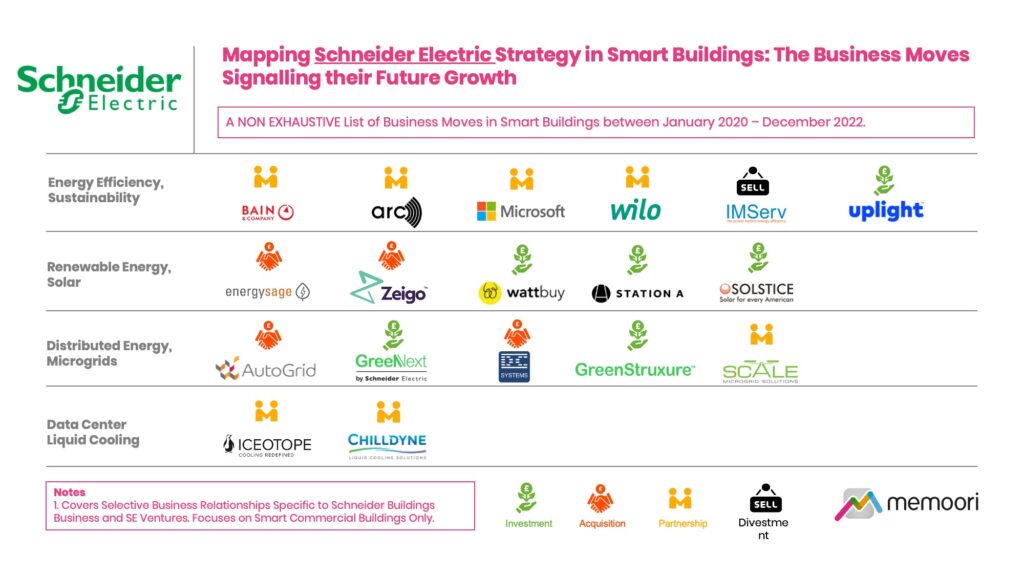

This Research Note examines the emerging strategic priorities of Schneider Electric in the smart commercial buildings space. We have mapped M&A, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the Buildings business. We have categorized the various business relationships by technology and investment type over a 3-year period. This article, Part 2 of a 2-part analysis (Part 1 Here), is intended as a non-exhaustive indicator of Schneider Electric’s strategic direction between January 2020 and December 2022.

Buildings are one of four end markets that Schneider Electric addresses with a complete portfolio of products, solutions and services for residential and non-residential buildings through its Energy Management Division. The Group’s offerings in non-residential buildings focus on healthcare and life science facilities, retail stores, hotels, commercial offices and data centers.

In total, our strategy mapping exercise highlights 15 partnerships, 6 acquisitions, 2 divestments and 10 venture capital investments of relevance over the last three years.

The commentary below highlights key investments and partnerships in the last twelve months.

Schneider Electric Energy Efficiency & Sustainability

In January 2023, Schneider Electric and Bain & Company, an engineering consulting business, announced a strategic partnership to advance corporate decarbonization ambitions and accelerate progress on energy efficiency, renewable energy procurement and electrification. The partnership follows a series of existing collaborations that have demonstrated the impact of the companies' combined expertise for clients.

In November 2022, Arc Skoru, a US technology company that is affiliated with Green Business Certification, Inc and the U.S. Green Building Council, partnered with Schneider Electric sustainability to create a new Efficiency Analysis model— a set of advanced tools to track, and analyze and prioritize efficiency improvement opportunities.

In June 2022, Schneider Electric won the Energy & Sustainability 2022 Microsoft Partner of the Year Award for its EcoStruxure software solutions provided to customers that were powered by Microsoft technology, including Azure Cloud and Dynamics 365.

Renewable Energy

In January 2022, Schneider Electric acquired Zeigo, a UK-based start-up providing a renewable energy platform. The acquisition complements Schneider Electric’s portfolio of clean energy services and solutions and advances the company’s digital energy transformation ambitions. By combining Zeigo’s AI capabilities with its existing advisory services, Schneider Electric will deploy collaborative intelligence in the energy and environmental commodity procurement process, an ideal complement to existing Schneider Electric solutions for their aggregation and digital platforms, EcoStruxure Resource Advisor and NEO Network.

In February 2022, Schneider Electric purchased a controlling stake in EnergySage, a U.S. online comparison-shopping marketplace for rooftop solar, energy storage, project financing, and community solar solutions for residential and commercial customers. The acquisition will help accelerate a shared vision for transforming the clean energy market and provide EnergySage with the resources to speed up the company's growth and product innovation. EnergySage will build new solutions for high-efficiency HVAC, smart home devices, and other clean energy products and services, and will scale its business globally.

Distributed Energy & Microgrids

AutoGrid, a Silicon Valley startup based in Redwood City, California, offering a software platform applying AI to flexible energy resource optimization, announced in May 2022 that it had signed a definitive agreement to be acquired by Schneider Electric. This is the culmination of a series of partnerships and investments by Schneider Electric since 2013, the aim of which was to accelerate AI adoption in the power sector and put Autogrid’s data analytics and machine learning to use in managing distributed energy resources and microgrids for industrial and commercial customers.

Data Centers & Liquid Cooling

In April 2022, Schneider Electric and Iceotope announced a joint initiative to embark on an immersion liquid cooling proof-of-concept (PoC) in Singapore for ST Telemedia Global Data Centres (STT GDC). The project leverages Iceotope’s chassis-level precision immersion technology, which uses dielectric liquid as a heat transfer medium instead of air, which provides higher thermal transfer capacity and improved efficiency. In addition, with the prospect of all-liquid-cooled data centres in the future, this technology promises to reduce the reliance on some of the traditional energy-hungry components of the cooling ecosystem such as chillers and computer room air-conditioning units.

Schneider Electric is one of the leading investors and partners in the smart buildings space. The business has committed considerable resources to open collaboration and co-innovation through alliances, strategic investments and venture capital funding.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.