In February, when the coronavirus epidemic became a global pandemic, few would have sincerely predicted that the crisis would have continued to the situation we find ourselves in today. As of mid-October, less than 15% of office workers have returned in New York City, the largest office market in the US, according to the Partnership for New York City.

The situation in other US cities is similar, average office building occupancy rates nationwide stand at around 25% as increasing outbreaks force, or strongly encourage, an extension of remote work policies. Certainty about the end of the crisis has not increased much either, leaving employers and building owners in limbo on when we might return to the office, with an increasing number asking if the workplace will ever be the same again.

“Offices and office workers are in a holding pattern, not ready to commit to working from home or the office. And the future of the office, if it’s going to be substantially different, has yet to be realized for many reasons that have nothing to do with the office itself. A whole spate of other issues — transportation, child care, trust in society and coworkers — is informing employees’ decisions not to go back just yet,” writes Rani Molla in an article for Vox. “Still, many employers want workers back in the office, and many employees want to be back. Both employers and employees, however, say the availability of a vaccine is a main consideration before returning to the office.”

Despite the rhetoric of political figures seeking re-election or global recognition, it has been clear since the beginning of the pandemic that a vaccine would not be available in 2020. If a vaccine can be brought to market within the next 12 months it would represent the quickest vaccine development in history, but the seemingly unpredictable behavior of the COVID-19 virus does not make such record-breaking seem likely. Furthermore, the distribution of a vaccine would likely take years more, meaning the “new normal” we have been living in since March may drive us into a new world before we have a chance to return to the old one. While some have clung to hope, others are increasingly accepting the harsh reality of the science.

When the outbreak began, it is probably fair to assume that the biggest companies in the world hired the leading experts to predict how the pandemic would unfold, and by early May the likes of Google, Facebook, and Apple had already ruled out a return to the office before the end of this year. At that time, Microsoft had outlined an October return, before joining Twitter’s parent company, Square Inc., in announcing a permanent shift to remote work for its global workforce.

While many firms prepared for a return to the office when restrictions eased over the summer, those with the greatest resources to forecast the evolution of the pandemic stuck to their long-term remote work strategies. As we approach November, it is safe to say that their predictions were right and maybe even conservative.

Going further, this month Google announced the rebranding of G Suite, the firm’s range of digital productivity applications will now be called Google Workspace. In July, the company began to integrate its Chat, Meet, and Docs applications into Google Drive and Gmail. Now, alongside the rebrand, they introduce new features and pricing structures to represent the new work environment. The company reported that Google Workspace will begin life with over 2.6 billion monthly active users, an increase of 30% from the 2 billion users its predecessor, G Suite, reported in March just seven months earlier. While the rebranding is largely symbolic, the user numbers indicate an undeniable shift.

“Work is no longer a physical place that we go to, necessarily,” Google Workspace VP Javier Soltero said yesterday in a press briefing. “Even though we’ve had mobile technology in the past, and people have been able to do some work on the go. The idea that we’re able to build and run organizations, governments, financial institutions, any size of business, and do it in a way that doesn’t require a physical presence that was previously referred to as an office will stay with us. Not because we will never return to offices, but because I think it’s important to note that work will take place everywhere in between and that those offices will take on a different role.”

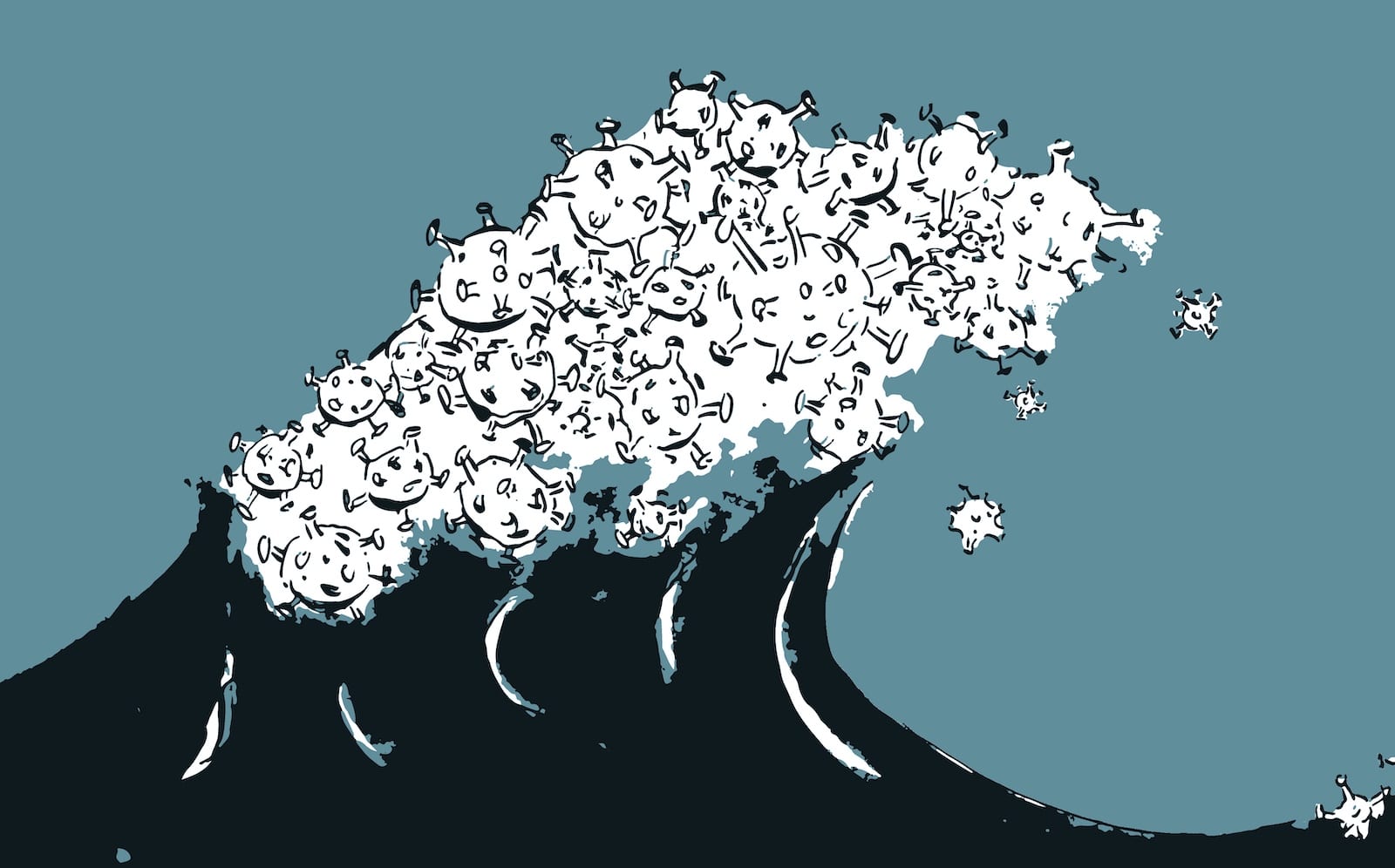

As second waves of COVID-19 sweep across the world, summer hopes of return are quickly drowning as the tide turns towards a mass acceptance of long-term remote work. Few now talk of the imminent return to the office, instead companies are settling in for a remote working winter and many will now know better than to raise their hopes again in spring.

Furthermore, the politicization of vaccine development has done little to foster confidence in a swift end to the pandemic in 2021. However, while the fate of physical offices hangs in the balance, the workplace will survive, evolve, and thrive through the digital tools that continue to create resilience for companies in this extended age of uncertainty.