The transformation of Building Automation Systems (BAS) into a Building Internet of Things (BIoT) is now underway. But as the plot as yet to unfold the full impact of what BIoT will mean to the BAS industry is not well understood.

Memoori’s new report The Transformation of BAS into the Building Internet of Things 2015 to 2020 shows that major disruption is on its way as both the competitive landscape and the supply chain will change for all those suppliers that want to engage in the wider BIoT business

The starting point to establish the future potential for BIoT has to be to size the current market for all Building Automation Systems and project that demand until 2020. From this base we can best estimate how and where the IoT portion of BIoT will progressively establish itself. The BAS services contracts will for the most part remain unchanged but parts of it such as supervisory software and enablement hardware will become part of the IoT system within the wider BIoT ensuring that everything will communicate along the common IP platform.

This will of course reduce the share of the BAS content within the fast growing BIoT business as the penetration of BAS morphing to BIoT grows. Other issues that we have taken into account that will determine how fast the development of BIoT encroaches upon BAS services include wireless technology which is vital for retrofitting existing buildings, substantial cost reductions in all core components of IoT and the creation of value add services through convergence with corporate business systems.

Sizing of the Building Automation Business

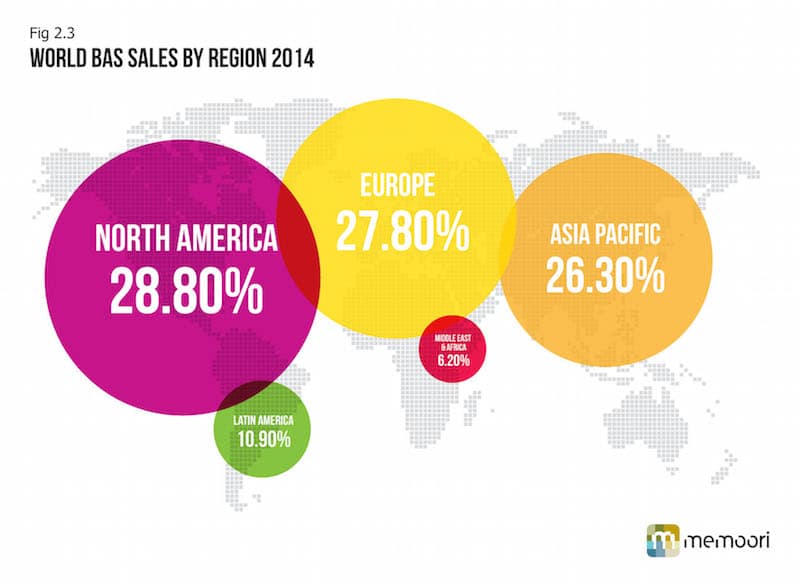

We estimate that the world market for BAS at installed value in 2014 was $120Bn. This was shared between nine services include Access Control, Building Environmental Control Systems (BECS / HVAC Control), Energy Enterprise Software, BAS Integration Services, Intruder Alarms, Lighting Controls, Video Surveillance, Fire Detection and “Others”. The average compound growth rate from 2010 to 2014 was approximately 8%. There is wide variation in market share of each service ranging from Video Surveillance at 24.7% to Lighting Controls at 4%.

[contact-form-7 id="3204" title="memoori-newsletter"]

We forecast that from 2014 to 2020 BAS services will grow by a CAGR of 9% with Video Surveillance achieving 11.25% growth and being the largest single market. We believe that video cameras will be the king of sensors connected to more points than any other sensor in the BIoT. IP network cameras have grown at a cagr of more than double this over the same period. Bus Based Lighting Controls starting from a much smaller base will realise a CAGR of 17%.

Sizing of the Building Internet of Things Business

We estimate that New Construction projects including major refurbishment account for as much as 70% of the value of all BIoT business today in the developed markets of the world and even more in developing markets. This could change depending on the state of the construction industry at any one time. The retrofit market in the future could amount to 30% plus in some years.

Major BAS Systems suppliers are likely to target their legacy estate and offer to install a turnkey BIoT contract and this could be attractive to their customers although it may be less open and with a lower content of plug and play, which could inhibit its long term value.

Retrofitting BIoT to existing Smart Buildings is unlikely to be cost effective until prices come down and customers have recouped some of the original investment. To strip out all or some of the existing control and monitoring systems may require the building to be closed down causing further costs. Until we have learnt from the many lessons of installing BIoT on new construct projects few comprehensive BIoT systems will be installed in existing Smart Buildings. The development of wireless controls will have a major impact on the uptake of BIoT in retrofitting existing buildings.

We expect In order for the Building Internet of Things (BIoT) to deliver a comprehensive and cost effective solution across all the services that now co-exist in Smart Buildings it will require fundamental changes on how these systems are designed and contacts to install are let. We expect that in the future, BIoT will be organised around 4 main contracts including; BAS hardware, Enablement Hardware, Network Communication and IoT Data Services / Big Data.

Our assessment shows that we see major opportunities for growth across all 4 contracts. Initially much of the investment will involve developing connectivity through the upgrading of Network Hardware, before being overtaken by a much faster growing IoT Services / Big Data Market by 2020. Wireless controls will need to develop fast if we are to penetrate the massive latent retrofit potential.

For more information on our research into how Building Automation will transform into the Building Internet of Things, visit our website - http://memoori.com/portfolio/transformation-BAS-to-BIoT-2015-2020/