Not surprisingly the introduction of LED Lighting has given a major boost to smart lighting controls right across the globe; but we are now entering a new phase of its development, when LED will be dependent upon smart wireless controls, if it is to open up the vast retrofit market in the commercial and industrial building space.

The LED lighting companies will soon need this business. LED is not creating a new market but is replacing an existing one and progressively each year it loses the conventional bulb replacement business which was (and still is for the time being) a cash cow. LEDs last for the lifetime of the fittings which means little possibility of regular revenues. Therefore they will need to open up the retrofit market; and they need wireless controls to enable this.

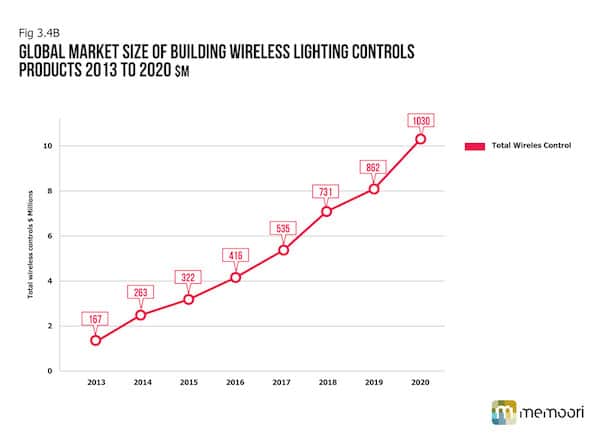

Memoori’s market research report “The Smart Wireless Controls Market for Lighting 2014 – 2018” estimates the world value of smart lighting control product in 2013 at $1.668 billion at factory gate prices and of this only 10% accounted for wireless controls. We forecast that the global market for Lighting Controls from 2013 to 2020 will grow at a CAGR of 12%. However wireless controls will grow more rapidly and by 2020 will account for some 23% of the smart lighting controls market. Wireless controls currently provide the only means of delivering an acceptable return on the building owner’s investment and that is the driving force because its growth opens up the enormous technical latent potential for retrofitting the vast building stock across the world.

The report shows that although most of the wireless controls technology has evolved in the developed countries of the world over the next 7 years growth in the developed markets of Europe and North America will fall behind China an Asia where it will well exceed the average CAGR of 30% across the world.

These figures do not include any other controls or value add services that could well become part of the lighting controls contract. Developing countries, particularly China and Asia may take up the initiative to go for wireless in new construct buildings where they see it providing the platform for the Internet of Things (IoT). Resistance to wireless control is a little more entrenched in the western world.

Looking back over the last 7 years shows a volatile and disappointing performance for the lighting controls business. From the liquidity crisis in 2007 and the financial meltdown in 2008, trading conditions have been very poor and particularly so in the commercial and industrial building industry. Demand in new construction has since picked up and therefore lighting and its control has seen an increase in demand since 2010. At the same time the introduction of LED Lighting has further increased demand and in order to deliver a low carbon economy in the 21st century this growth has to be sustainable.

Our forecast for a CAGR of 30% for wireless controls is indeed a high rate of growth particularly for a rather mature lighting business but is still a relatively small percentage of the potential that is currently available. The big major imponderable is when will the retrofit market really kick in.

What is needed now is a major awareness campaign backed by government agencies to target building owners on the benefits of LED Lighting and its control. They are the ones that will have to make the investment decision and therefore the case for doing so has to be centered on what’s in it for them.

We have identified 20 companies that we believe have the products and resources to grow this market at the rate we have forecast and more. They have been taken from our listing of 121 lighting controls companies so it’s very likely that there are more challengers out there. The report also details how building the supply side through M&A and Venture Capital is strengthening the business. Investors are attracted to this market for its relatively low risk but high growth prospects - http://memoori.com/portfolio/smart-buildings-wireless-lighting-controls-2014-to-2018/