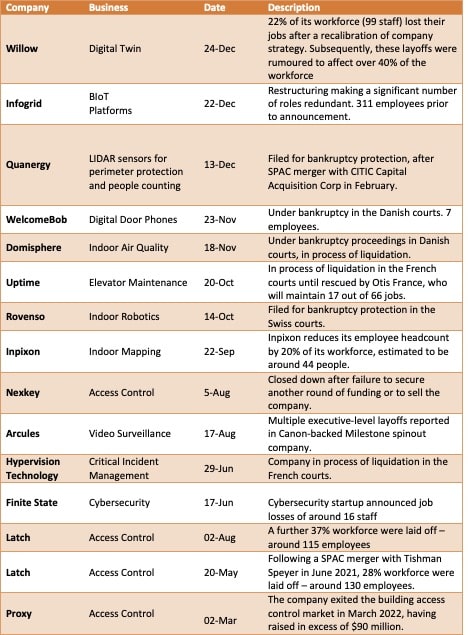

We have been keeping track of the notable layoffs and bankruptcies in 2022. The table below highlights 15 companies that have cut staff or closed last year. These are certainly not the only companies cutting costs and reducing personnel.

However, it is apparent that even though the commercial smart building space has not been immune to the impact of the external environment over the past twelve months, the sector has not been as badly affected as the tech sector overall.

Job Losses and Closures in the Smart Building Space in 2022

Several different circumstances can be attributed to the smart building technologies job losses and closures outlined above:

- Startups with strong growth trajectories have not been immune from cutbacks (eg. BIoT company Infogrid & Digital Twin company Willow), as further funding from investors as been contingent on cost reduction or moving to a more profitable business model.

- Some startups ran out of cash having been unable to raise further funding (eg. Rovenso, Nexkey).

- Smart building public companies created from SPACs (Special Purpose Acquisition Companies) were particularly vulnerable.

- Other listed companies such as Inpixon needed to reduce operational overheads to bring the company closer to cash flow positive and to achieving profitability.

- Some smart building companies who filed for bankruptcy protection were rescued from receivership, eg. Uptime, Sigfox.

We expect job losses and closures to continue into 2023 in a tough investment landscape and continuing economic slowdown.

This article was written by Daphne Tomlinson, Senior Smart Building Research Associate at Memoori.