Sadly the slow drip of unnerving news about sovereign debt in Europe and double dip recession has continued. The politicians are making ominous noises that the effort to reduce CO2 reductions may have to be reigned back.

George Osborne, Britain’s Chancellor of the Exchequer, in a potentially explosive intervention, insisted the government will only cut emissions in line with its neighbours in order to ensure British businesses are not put at a disadvantage. The Chancellor accused environmental regulations of “piling costs on the energy bills of households and companies” and argued that the government should not adopt green targets that damage the business sector.

The finger is being pointed at the high cost of electricity produced from renewable sources such as wind and solar power. There is no question that the programs to increase the share of electrical generation from these sources will not continue, but in the short term expect more power from high efficiency gas turbines to replace old coal fired power stations.

So what impact will this have on the world market for Smart Grid? ‚Â One school of thought is a lot; because you would not need to make the Grid so smart because it would not have to accommodate so much variable power. So let’s dumb it down and save some money! That would be a disastrous move because you would lose all the benefit of major efficiency gains and the added value through the Internet of Things (IoT). Eventually we will still be faced with getting the majority of our electrical power from renewable sources and the only way that can be achieved is through Smart Grid.

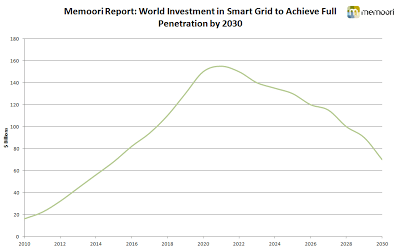

In our report “World market for Smart Grid & Forecast to 2030” due to be published in January 2012, we have extended the time it will take for the major countries to achieve full penetration of their electrical grid to the year 2030.

The graph above show sour forecast of how the investment of $2,000 billion will progress over the 20 years from 2010. This shows that expenditure will peak at $155 billion in 2021.

The programs for the different product categories of plant will not run in synch. For example AMI expenditure will peak in 2014 and will be completed in many countries before 2020. Whilst this is good news, if there is to be a cutback on investment programs it would be sensible to hold back on AMI and invest more in automatic demand response. This way we get a joined up system sooner that will produce a much higher ROI than that from any of the individual parts.