This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.

At the World Economic Forum event in Davos in Jan 2020, Christian Ulbrich, CEO of JLL

spoke with Business Insider remarking that space utilization technology was likely to have a particularly high impact for the company by lowering costs and creating better employee experiences

Our new report on Occupancy Analytics and In-Building Location Services confirms the predominance of workspace management platforms in CRE deployments providing a range of solutions addressing multiple use cases.

JLL, the second largest global commercial real estate services firm, has already invested in a number of platforms addressing space utilization and occupant engagement solutions, which help tenants make best use of their buildings.

San Francisco startup company, VergeSense announced a $1.5M strategic investment in October 2018 led by JLL Spark, the division of JLL that manages a $100M venture fund connecting new technology companies with JLL’s business lines and clients. The sensors from VergeSense can measure the exact occupant count in conference rooms, and when deployed in open-office areas, are capable of measure individual desk occupancy - all from a ceiling mounted device. The hardware is equipped with computer vision and AI technology to provide both the flexibility and power needed for temporary and permanent installations.

JLL Spark has more recently participated in a $34.25 million Series B funding round for the Boston, US-based company, HqO in December 2019. HqO’s tenant app gives employees all-in-one control over their workplace experience, and connects them to local amenities, e-commerce, events and the building community. Space booking through the HqO app is a simple way for property teams to promote reservable space on-site and manage tenant requests.

JLL’s investments are indicative of the move towards occupant centricity in the workplace which has emerged in the last two years. Corporate Real Estate and Facilities Management teams are shifting their focus away from technology towards individual use cases and their respective outcomes.

The focus of smart buildings has shifted from technology to user experience. Putting the user experience at the centre of the design process and using technology as a “means to an end, not the end itself” will enable the industry to deliver buildings that are fit for purpose.

The IoT is central to this process, as increasingly, buildings will be driven by data. Using the

data available through IoT allows more informed decision-making related to facility

operations and the use of the building by its occupants.

Navigating through the wealth of use cases in the smart building landscape is not easy. Although technology is evolving rapidly and offers a vast number of smart building solutions, there is no one path on how to transform an office into a more human-focused building. Our report discusses 39 use cases which are exclusively focused on occupancy analytics and in-building location-based services.

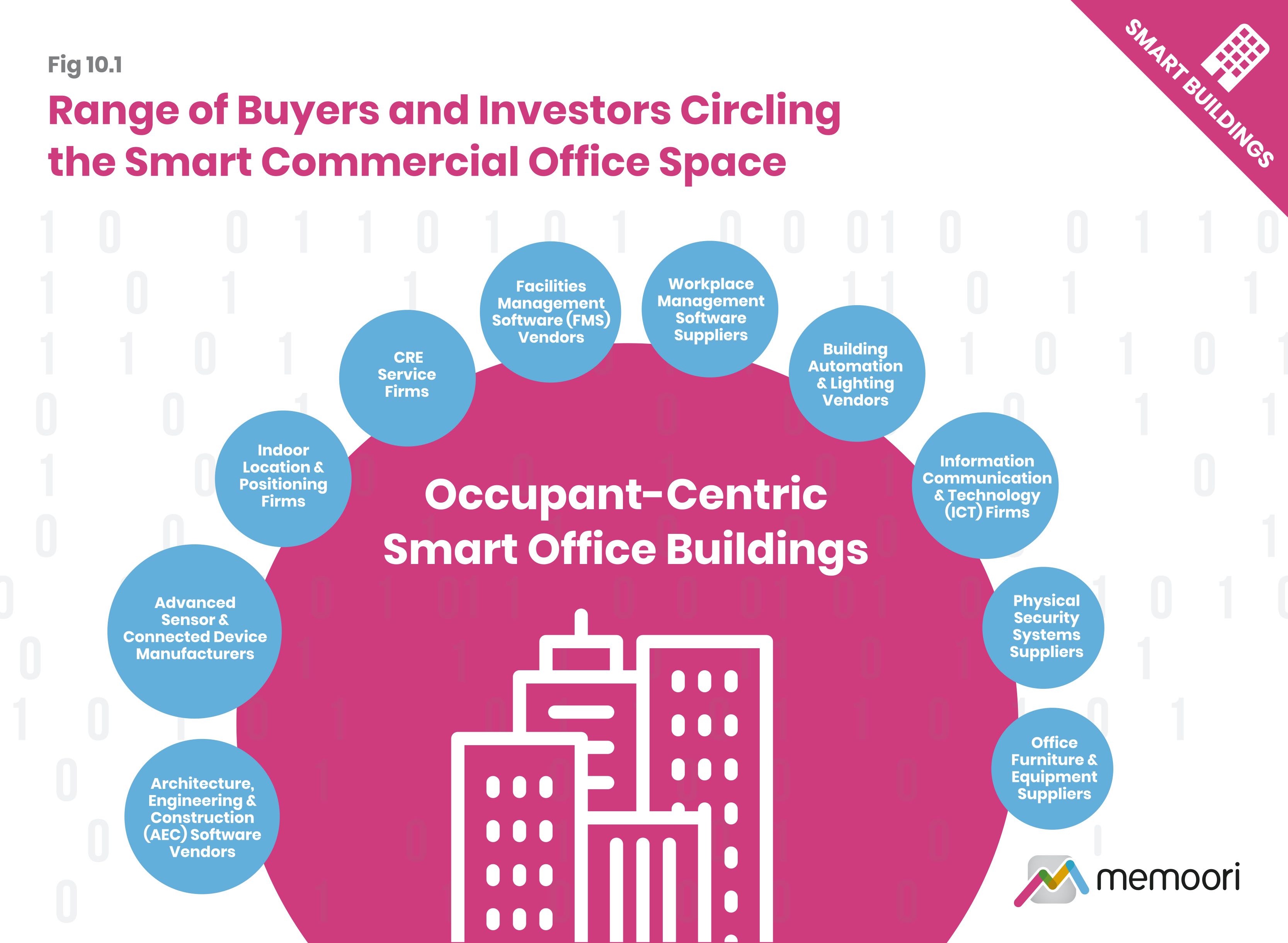

We have identified 9 platform types which can deliver the various use cases, derived from an analysis of the solutions provided by over 220 companies:

- Workspace Management Platforms: Software solutions which are focused on gaining insights into space usage and occupancy rates in office buildings.

- IWMS Platforms: An Integrated Workplace Management System aimed at Commercial Real Estate, which addresses five functional areas: space management, energy and maintenance management, capital project planning and lease administration.

- Occupant Engagement Platforms: This category of software covers those solutions which focus on engaging occupants, including tenants, employees and visitors, with easy to use smartphone powered apps and platforms for a range of activities in the modern office.

- Indoor Location based Platforms: Indoor location-based platforms which enable one to locate objects and people within buildings using indoor positioning technologies.

- IT Infrastructure based Platforms: Software solutions which measure office occupancy based on a solution which does not involve additional hardware, using the existing LAN and Wi- Fi infrastructure in the building.

- Connected Lighting Platforms: Connected lighting platforms which enable occupancy analytics and location-based services.

- IoT Platforms: Internet-of-Things Platforms which integrate a range of building and facility management applications including occupancy analytics or location-based capabilities, connected with the building management system.

- Safety & Security focused Platforms: Safety and security solutions incorporating occupancy or location-based functionality such as mobile access control and data-driven emergency response.

- Sensors and Sensing Platforms: Sensor hardware and sensing solutions providing sensors and a cloud platform for occupancy analytics and location services.

While workspace management platforms are the most prolific, they are closely followed in number by indoor location-based platforms and sensing platforms. However, we believe that as smart workspace technologies continue to flood onto the market, IWMS platforms are well placed for occupancy analytics in view of their established position as real estate software solution providers and their focus on integrated platforms.

IoT platforms are also likely to take the lead in the commercial office space, particularly for large complex buildings, where there is an expectation to integrate the solution with building management systems and other enterprise management systems.

At 208 pages with 39 charts and tables, this is our 2nd comprehensive evaluation of these solutions and services includes a detailed assessment of global market projections, together with appendices listing over 220 suppliers, M&A and investments.

Follow to get the Latest News & Analysis about the Competition in your Inbox!