This Research Note examines the French public company, SPIE and its focus on building solutions, which is one of four strategic markets that the group addresses in central and northern Europe.

This article covers the Group’s fields of expertise, its development since 2013 through platform and bolt-on acquisitions and its expansion in the Netherlands, based on recent press releases, 2022 Universal Registration Document, SPIE profile and key figures.

SPIE Profile

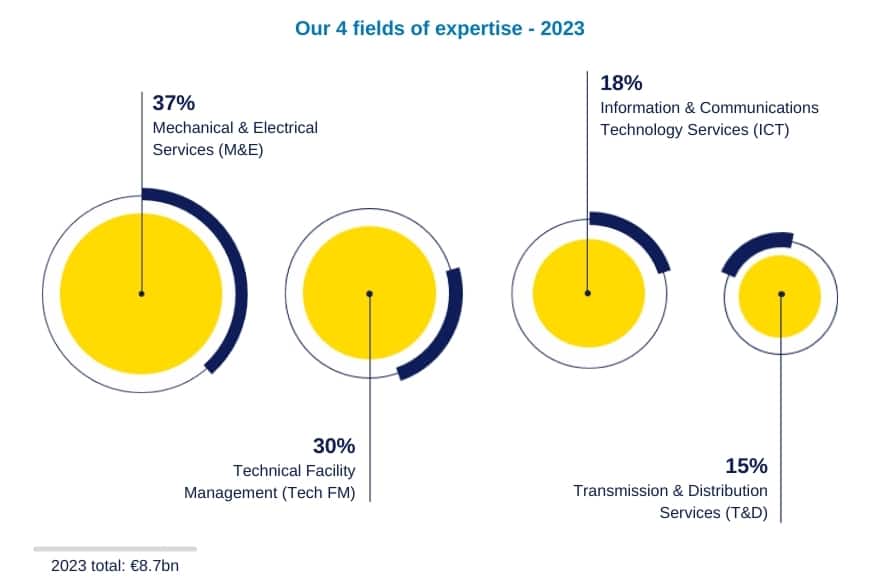

As a leading independent European pure player in multi-technical services in the areas of energy and communications the Group reported 2023 revenues of €8.7 billion.

SPIE relies on four fields of expertise, supporting its customers to design, build, operate, and maintain energy-efficient and environmentally friendly facilities.

- Mechanical and Electrical Services – 37% of 2023 revenues

- Technical Facility Management – 30%

- Information & Communications Technology Services – 18%

- Transmission & Distribution Services – 15%

Regional Presence

SPIE focuses its business development on five northern European countries – France, Germany, the Netherlands, Belgium, and Switzerland – as well as in Central Europe. SPIE considers itself as the leading player in the Dutch multi-technical services market, the second largest player in the German market and one of four major players in the French multi-technical services market.

Memoori notes that SPIE fully exited the UK market in December 2022 when it divested its UK business to Dalkia UK.

Platform and Bolt-On Acquisitions

Two platform acquisitions have enabled SPIE to consolidate its market share in the technical facility management and building services market.

In September 2013, the Group purchased Hochtief’s Services Solutions business in Germany, thereby obtaining a presence in the German market and de facto becoming one of the lead players in the German integrated multi-technical maintenance market, offering solutions dedicated to improving the energy efficiency of customers’ installations.

In January 2022, the Group acquired Worksphere, a Dutch specialist in technical facility management and building services, which uses methods and expertise based on data collection and analysis to make buildings smarter and more environmentally friendly. With this acquisition, SPIE becomes the leading multi-technical service provider in the Netherlands, capitalizing on the strengths of its pure-player model. With 1,900 experienced employees, Worksphere generated revenue of €434 million in 2020.

At the same time, for over 15 years, SPIE has been pursuing a strategy based on bolt-on acquisitions, i.e., the acquisition of a significant number of small- or medium-sized companies, enabling it to (i) develop the local density of its presence, (ii) reinforce the range of services on offer and (iii) extend its geographical cover.

Due to the considerable fragmentation of the markets in which the Group is present as well as the significant and recurrent generation of available cash resources, one part of which is re-invested each year in external growth, this strategy forms the foundation for SPIE’s growth model. Since 2006, SPIE has completed 140 bolt-on acquisitions.

Recent Expansion in the Netherlands

In October 2023, SPIE expanded its Building Solutions division in the Netherlands with the acquisition of IMI Aero-Dynamiek. IMI Aero-Dynamiek is a Dutch company that contributes to making buildings more sustainable by measuring, validating and optimising HVAC systems.

With this acquisition, SPIE wants to further strengthen its position in these services and more specifically for the healthcare, bio-lifescience, food and semiconductor sectors. The 65 employees of IMI Aero-Dynamiek will join SPIE. IMI Aero-Dynamiek generated a revenue of around €6 million in 2022. This acquisition follows the integration of Worksphere into SPIE Netherlands augmenting their positioning as market leaders in the technical building-related environment.

In the fragmented European technical facility management and building services market, SPIE is one of the major players, competing for business with Dalkia, Caverion, Apleona and many other local and regional firms.