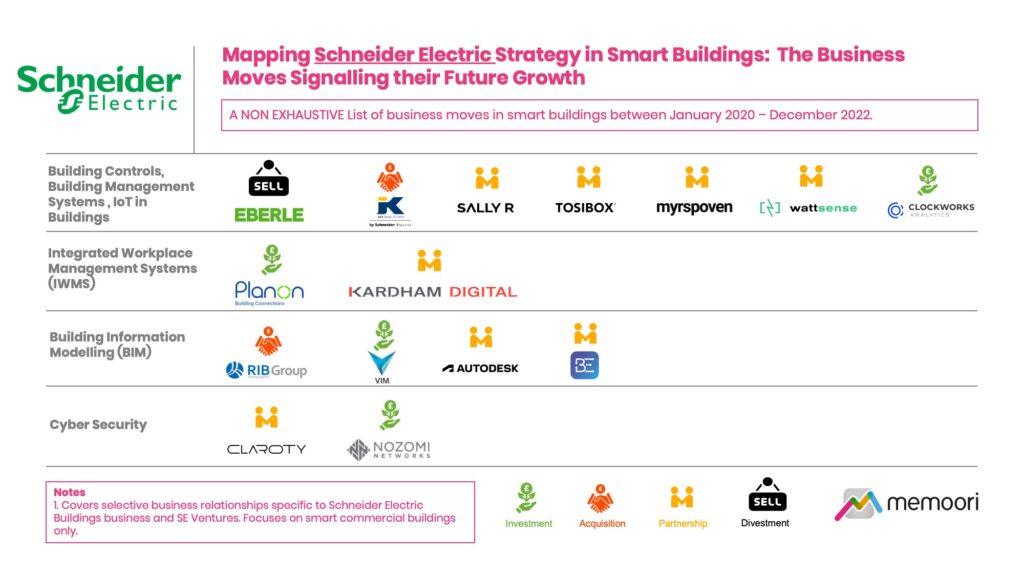

This Research Note examines the emerging strategic priorities of Schneider Electric in the smart commercial buildings space. We have mapped M&A, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the Buildings business, by categorizing the various business relationships by technology and investment type over a 3-year period. This article, Part 1 of a 2-part analysis, is intended as a non-exhaustive indicator of Schneider Electric’s strategic direction between January 2020 and December 2022.

Schneider Electric established its Corporate Venture Capital unit, SE Ventures in November 2018 which has closed 34 direct investments and completed 3 exits since founding together with venture incubation programs, partnerships and joint ventures. In November 2022, the VC unit announced a €500 million Fund II, bringing SE Ventures to €1 billion of committed capital and establishing itself as one of the largest venture capital platforms focused on electrification, digitization and decarbonization.

In total, our strategy mapping exercise highlights 15 partnerships, 6 acquisitions, 2 divestments and 10 venture capital investments of relevance over the last three years.

The commentary below highlights some of the key investments and partnerships in Building Management Systems, IoT Platforms, Integrated Workplace Management Systems (IWMS), Building Information Modelling (BIM) and Cyber Security.

Schneider Electric Building Management Systems & IoT Platforms

Schneider Electric has committed considerable resources to collaboration and co-innovation with startup firms in the building automation sector through alliances, strategic investments and participation in funding rounds.

In September 2022, they published a case study referencing Myrspoven, a Swedish startup which provided AI-driven software for EcoStruxure Building Operation solution at a recent installation for SISAB, the owner and operator of most of Stockholm’s school buildings.

In May 2022, they announced a collaboration with Tosibox, a Finnish provider of a secure OT (operational technology) networking and remote connectivity solution widely utilized in building and industrial automation. Hundreds of Schneider Electric´s customers in the Nordic region are already connected to Schneider Electric's EcoStruxure Building Operation platform via Tosibox.

In April 2022, they acquired a German BMS system integrator, J&K Regeltechnik to further strengthen its geographic reach in large projects in metropolitan regions and cities such as Rhein-Main, Frankfurt and Munich. While, in December 2022, Schneider Electric divested its German HVAC controls company, Eberle, to Eberle’s management and private equity company Borromin.

IWMS

In December 2020, Schneider Electric made a strategic investment through a 25% minority stake in Planon Beheer BV, a software provider in Integrated Workplace Management Systems (IWMS). The combined aim of the partners is to digitise the operations and maintenance activities in the building lifecycle through the integration of both EcoStruxure and Planon’s enterprise-scale solutions. The consideration paid amounts to EUR 113 million in cash.

In October 2022, they collaborated with Kardham Digital and Planon to launch a single integrated smart building and smart workplace offering covering all building issues, including energy efficiency, data governance and integrated workplace management services, acting as a general contractor for building IT topics.

BIM

Headquartered in Stuttgart, Germany, RIB, a listed company on the Frankfurt Stock Exchange was acquired by Schneider Electric in July 2020. With a global presence in over 50 locations and revenue of €214m in 2019, RIB offers a software platform for planning, costing and real-time construction monitoring, placing it as one of the leading players in the broader field of Building Information Modelling (BIM). The company has also developed software for the building operations phase and facilities management. RIB increases Schneider Electric’s share of software and service revenues, and enhances the group’s EcoStruxure suite.

BIM Electrical Corp., a subsidiary of Schneider Electric was established through a strategic alliance with Autodesk in 2020 to empower electrical engineers to drive long-term digital transformation that results in more sustainable and energy-efficient buildings. In September 2022, Schneider Electric unveiled their advanced BIM-based electrical design solution that integrates directly with Revit, creating a more complete and robust BIM solution that connects teams, data, and workflows across the entire electrical and new energy landscape project lifecycle.

Cyber Security

Following participation in a Series D investment in Claroty, Schneider Electric announced the launch in June 2022 of cyber security Solutions for Buildings, a joint solution that helps customers secure their building management systems (BMS) to protect their people, assets and operations.

In September 2020, Nozomi Networks Inc, a leading startup in OT and IoT security, announced its products were available on the Schneider Electric Exchange, making it faster and easier for Schneider Electric customers to integrate Nozomi Networks solutions into their existing EcoStruxure product architecture and other Schneider Electric energy and automation software, devices and services.

Part 2 of this Research Note will examine the emerging strategic priorities of Schneider Electric in Energy Efficiency, Renewable Energy, Distributed Energy and Data Centers.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.