This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.

Memoori’s biennial evaluation of startup companies has identified 665 private companies founded between 2011 and 2020 in the smart buildings sector. The diversity and range of companies addressing this market is quite striking.

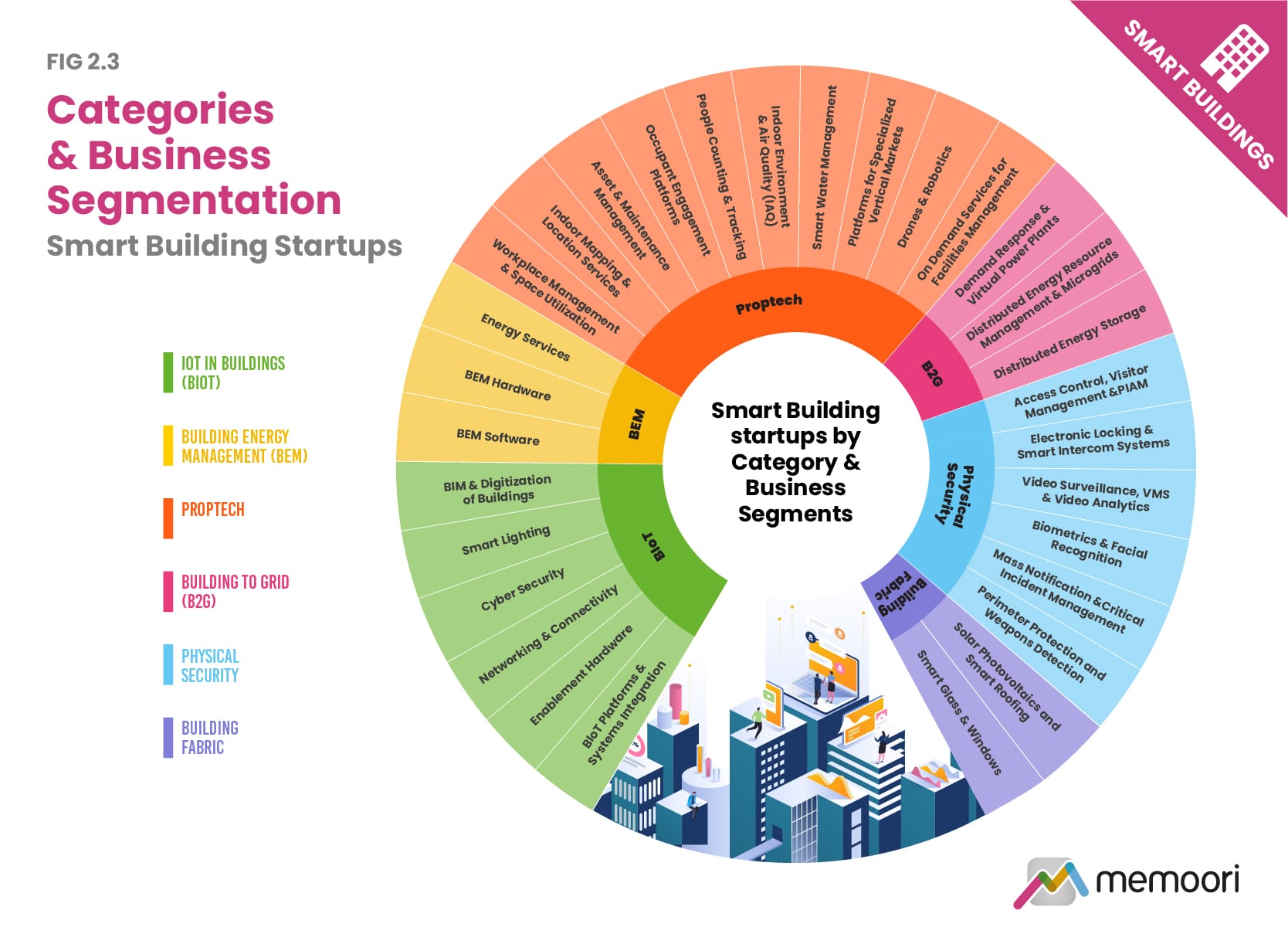

A comprehensive insight into the varied applications and technologies being offered by startups has been facilitated by a taxonomy (see Fig 2.3). 6 primary categories coupled with 30 secondary business segments provide a framework for deeper assessment of the business areas that startups are addressing.

* IoT in Buildings(BIoT): BIoT platforms and Systems Integration; Enablement Hardware; Networking and Connectivity; Cyber Security; Smart Lighting; BIM & Digitization of Buildings.

* Building Energy Management (BEM): BEM Software; BEM Hardware; Energy Services.

* Proptech: Workplace Management and Space Utilization; Indoor Mapping and Location Services; Asset and Maintenance Management; Occupant Engagement Platforms; People Counting and Tracking; Indoor Environment and Air Quality (IAQ); Smart Water Management; Platforms for Specialized Vertical Markets; Drones & Robotics; On Demand Services for Facilities Management.

* Building to Grid: Demand Response & Virtual Power Plant; Distributed Energy Resource Management & Microgrids; Distributed Energy Storage.

* Physical Security: Access Control, Visitor Management & PIAM; Electronic Locking & Smart Intercom Systems; Video Surveillance, VMS & Video Analytics; Biometrics & Facial Recognition; Mass Notification & Critical Incident Management; Perimeter Protection & Weapons Detection.

* Building Fabric: Smart Glass & Windows; Solar Photovoltaics & Smart Roofing.

Internet of Things technology has supported a diverse set of use cases in commercial and industrial buildings, which new entrants have been able to exploit.

The Internet of Things pervades the smart buildings space and is a major enabler for many of the startups identified.

While the BIoT category accounted for 22% of the total number of new entrants, companies are using IoT technology in specialized use cases across all six categories to deliver improved operational performance of buildings and enhanced user experiences. We document examples of BIoT platforms developed for occupancy analytics, wayfinding, energy efficiency optimization, access control and more in our new report.

Proptech. This category has attracted the highest number of new entrants, accounting for around 43% of the total number of companies. The report focuses on proptech startups which address the management and operational phase of the commercial and industrial building lifecycle across the ten sub-segments highlighted above.

Building Energy Management is still at the centre of the value proposition for commercial real estate, even though it is now just one part of the overall portfolio of solutions for the intelligent building, which has a broader focus on building users and performance improvements.

Building to Grid interface applications are defined in this report as solutions used to facilitate the connection between building control systems and the Grid, used particularly to manage automated demand response, dynamic energy procurement and distributed energy generation & storage in buildings and interface related data to the grid operator or energy utility. This topic has remained a constant theme in building technologies over recent years, as usage of distributed energy resources, virtual power plants and energy storage to power smart buildings is on the rise.

Physical Security & Safety focuses on solutions which support procedures for gaining entry and moving staff and visitors around buildings, protecting their perimeters and ensuring the safety and security of all occupants. We have seen a 23% increase in the number of startups in the last two years, which we attribute to the heightened emphasis on contactless technologies necessitated by the ongoing coronavirus pandemic.

Building Fabric. Advances in solar photovoltaics and smart glass have continued to play their part in improving access to renewable energy and green buildings. The recent focus on occupant wellbeing in buildings has also elevated the significance that outdoor views and natural light can have on building occupants, which has enabled window technologies offered by new entrants to enter a renewed era of interest.

The Startups and Their Impact on Smart Buildings 2021 report will be of value to all those engaged in managing, operating and investing in the smart buildings space around the world. In particular, those wishing to invest in or acquire startup companies will find it useful.

Within its 279 pages and 64 charts and tables, the report assesses the range and type of new entrants in the smart buildings space, segments their business focus, highlights the major trends and new business models associated with these companies, analyses their funding and stage of development and dissects the nature of their partnerships and alliances with the main players.