Carrier has announced strategic actions that will transform the Company's business portfolio and establish Carrier as a pure-play, intelligent climate and energy solutions company. They will acquire Viessmann Climate Solutions in a cash and stock transaction valued at €12 billion. They also plan to exit their Fire & Security and Commercial Refrigeration cabinet businesses.

This Research Note is based on the Carrier Portfolio Transformation press release, investor presentation and analyst call, 26 April 2023, Viessmann press releases and Memoori’s previous analysis of Carrier and Viessmann businesses.

With 70% of its business consisting of heat pumps and related accessories, solar PV, batteries and services, Viessmann Climate Solutions is a leader in Europe's energy transition. Headquartered in Allendorf, Germany with 11,000 employees, Viessmann Climate Solutions anticipates around €4 billion sales in 2023. The transaction multiple accounts for around 13x 2023E fully synergized EBITDA.

The Viessmann group has achieved record growth in the last two years +21% in 2021 and +19% in 2022 – accelerated by the high demand for green climate solutions. These include heat pumps with natural refrigerants, biomass, solar thermal, electric storage, green gases, and liquid green fuels, as well as air purification solutions and digital services.

Viessmann Climate Solutions will become a major driver of Carrier’s growth strategy for the residential and light commercial HVAC business in Europe.

Viessmann heat pump sales in Germany, Italy, France and Poland represent >50% of Europe's heat pump installed base with >20% CAGR. Germany accounts for 40% of sales.

Viessmann also benefits from a direct-to-installer business model, that includes more than 75,000 installers in 25 countries, in comparison to European competitors, who sell mainly through the wholesaler channel. These differentiators, combined with its innovative product offerings, have resulted in a superior growth track record and profile. Sales and EBITDA* have grown over 15% on a compounded annual growth rate basis since 2020, with double-digit growth expected to continue through 2030. 2023 forecasted EBITDA is approximately €0.7 billion on approximately €4 billion of sales.

Combined, Carrier and Viessmann Climate Solutions will generate total revenue of more than US$17 billion with about 45,000 employees.

This portfolio transformation marks the entry of one of the leading U.S. HVAC companies into the European residential heating market and with the technology and channel expertise of Viessmann, this strategic move by Carrier is an important accelerator of integrated smart home energy solutions.

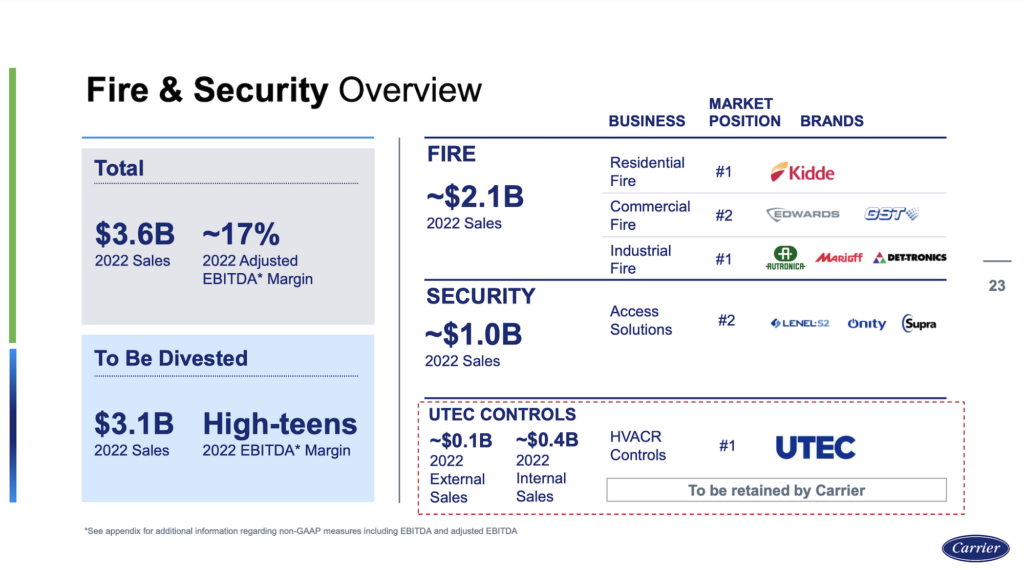

Carrier Fire & Security Exit

Carrier also expects to exit its Fire & Security and Commercial Refrigeration businesses over the course of 2024. The divestments will bring greater focus to Carrier's strategy and reduce operational complexity in its portfolio. The planned exits do not include UTEC, Fire & Security's controls business for residential HVAC customers.

Carrier's Fire & Security brands include Kidde, Edwards, GST, LenelS2, Marioff, Autronica, Aritech, Det-Tronics, Onity, Supra and Fireye. Bolt-on acquisitions in recent years include:

- In September 2021, Carrier acquired Broker Bay, a US developer of real estate scheduling software, which complements Supra electronic lockbox access solutions for North American real estate agents. The acquisition strengthens Fire & Security Access Solutions business.

- In October 2021, Carrier announced the strategic acquisition of Cavius, an innovative Danish residential alarm company that provides a complete range of smoke, heat, flood and carbon monoxide alarms. Cavius has developed the world's smallest photoelectric smoke alarm. Cavius strengthens Carrier Fire & Security's residential fire safety solutions in Europe, which includes Kidde products.

Carrier Ventures, the corporate venture capital arm of Carrier Global, has also recently invested in Hakimo, a technology company dedicated to modernizing physical security through its artificial intelligence (AI) software. The Hakimo platform uses computer vision and machine learning to automate the monitoring of physical security sensors such as cameras and badge readers. In November 2022, LenelS2 expanded its AI portfolio by offering the Hakimo solution which integrates with LenelS2’s OnGuard and NetBox access control systems, to its value-added reseller community.

Carrier repositioned itself as a core fire and security products business in 2021 with the sale of the lower margin installation business of Chubb Fire & Security. It could therefore be an attractive proposition for a competitor or private equity buyer.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.