Our new Report The Market for Building Performance Software 2016 to 2020 has estimated a world market worth $12.72Bn in 2015 that is forecast to grow to $18.75 by 2020 delivering a CARG of 8.1%.

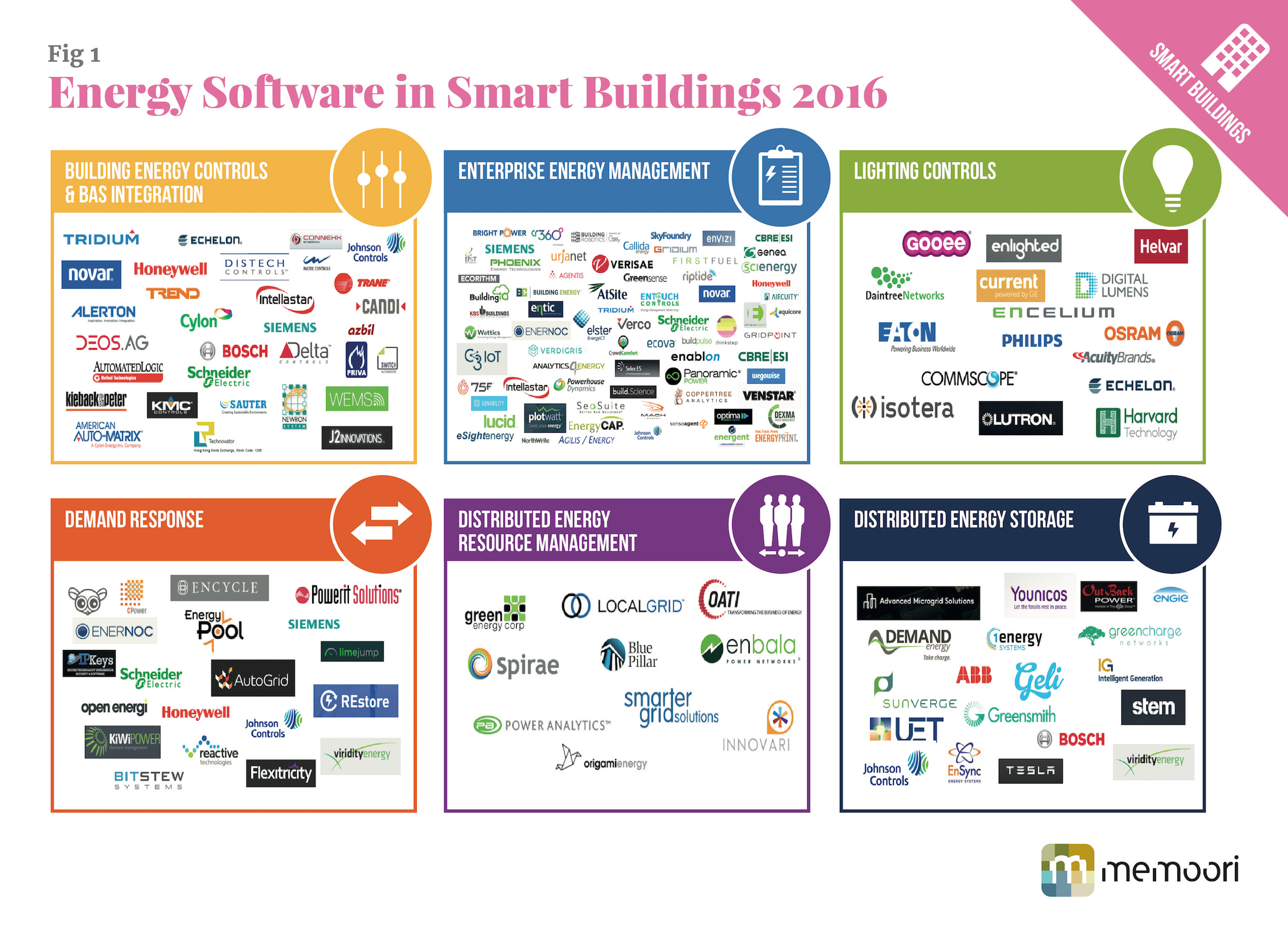

This is a very substantial growing business having some 350 established companies who are providing building performance software to 16 different market segments defined by type of application software package, that all improve the performance and operation of non-domestic buildings. This would suggest a very substantial average annual sale per supplier but there are many more small companies and massive overlapping of products that is making for a very fragmented market.

During the last 5 years we have tracked a total of 150 confirmed building performance software acquisitions that has consolidated the business, At the same time we have identified 167 funding announcements which has pumped a total of $2,385 million into 106 building performance software providers with most being new start enterprises.

During the last 5 years we have tracked a total of 150 confirmed building performance software acquisitions that has consolidated the business, At the same time we have identified 167 funding announcements which has pumped a total of $2,385 million into 106 building performance software providers with most being new start enterprises.

With this kind of funding from both angel investors and private equity companies this business is proving to be an attractive investment proposition but undoubtedly it is a very competitive landscape. Importantly, building owners and facility management professionals are confused with the plethora of products that duplicate each other and the supplier churn. This is particularly so when they now being advised to investigate the Building Internet of Things (BIoT).

The current vendor landscape includes some big players with deep pockets and significant development resources, like Honeywell, Schneider Electric, Siemens and GE Current. As well as specialist companies that supply a few of the application segments such as Trimble, Yardi and Archibus and are well established in these markets.

Smaller companies that are trying to compete right across the building industry through the race for "feature functionality" have a very difficult task and are more likely to be successful through either focusing on differentiating within a unique set of features appropriate for one or more of the 16 application segments identified in the report. Clients for these products will include the big players that cover whole building performance software business and building owners that can immediately see the benefits satisfy their buying proposition.

It is our belief that the BIoT will eventually form the structure of making buildings fully automated and optimised without the need for human intervention, essentially “flying on auto-pilot”. To do this all of the data from the 16 software packages detailed in this report will need to be processed and analysed by Big Data software services. This will be a threat and opportunity, requiring the building performance software suppliers to re-evaluate and adapt their business models.

[contact-form-7 id="3204" title="memoori-newsletter"]