“The Industry Alliances and Consortia universe is still a bit of a mess,” states our new report The Internet of Things in Smart Commercial Buildings 2016 to 2021. The in-depth report explores the emerging sector for connected devices in a commercial real estate market that is quickly becoming a major driving force in the internet of things (IoT) movement.

In fact, smart buildings account for 63% of connected devices in smart cities, which in turn make up 47% of all connected devices. As the market grows, more and more companies jostle for position, inevitably and increasingly alliances and consortia were formed to bring order to the technology’s development.

Memoori, along with other industry commentators have previously expressed concern that the deployment of IoT could be hindered, rather than helped, by the existence of so many competing consortiums, as many would-be players in the technology scene are adopting a wait and see attitude while the standards landscape evolves.

A multitude of industry alliances and consortia have been established in recent years each with the hope to create a common standard for the IoT. More often than not these groups have overlapping remits, not least to speed the growth of the IoT. Through their formation these alliances have the capacity to create common standards, enhancing interoperability, and simplifying steps such as device discovery, security and authentication between Machine-to-Machine (M2M) systems.

“To date, the big BAS suppliers have not taken a lead role in these consortia,” our report highlights. However “it is also interesting to note that although the building controls players are represented in the majority of the major alliances and consortia, they are only taking a lead role in the activities of the Thread group, and relative to some of the largest IoT players, their overall involvement is limited”.

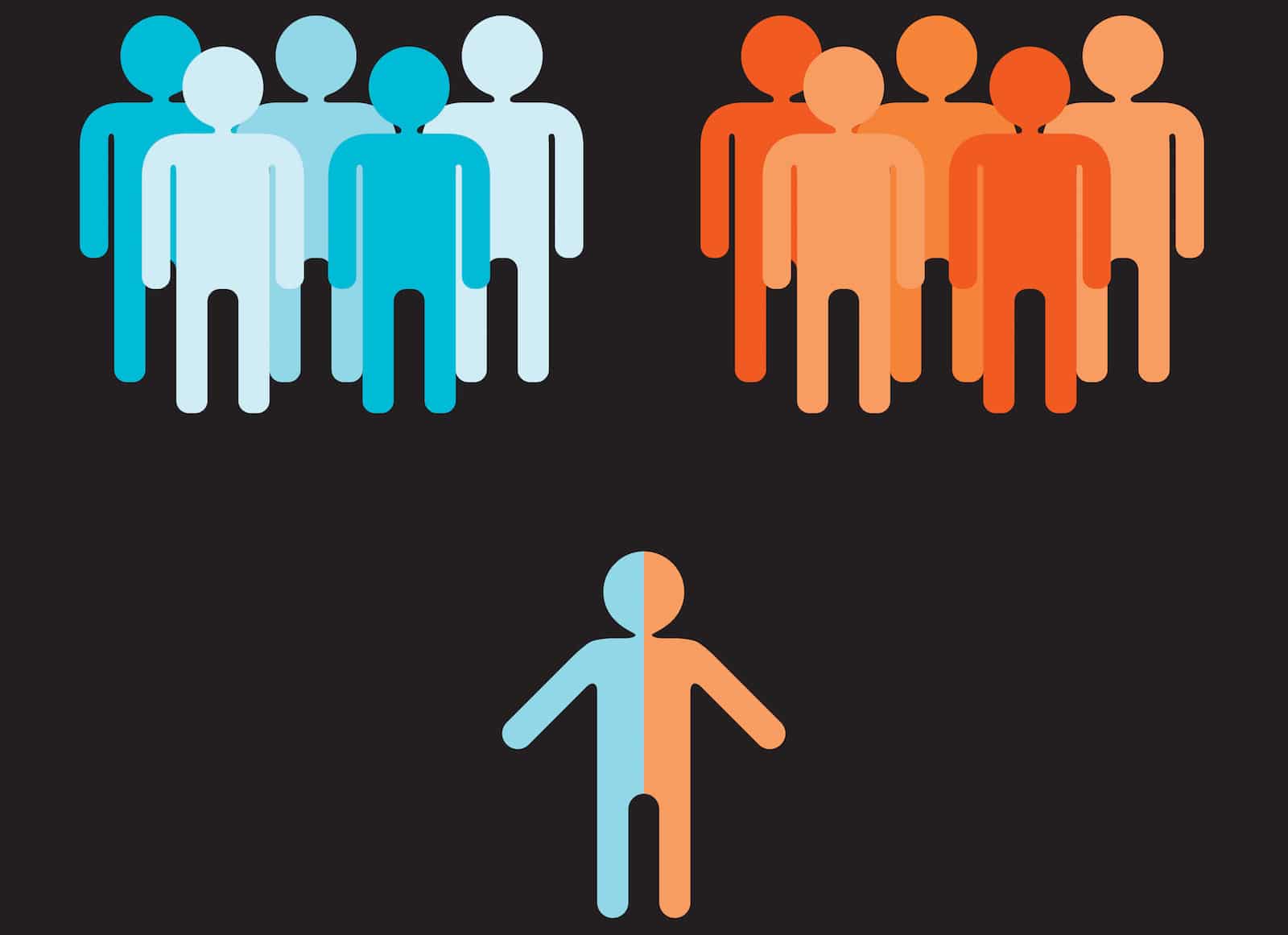

Numerous programmers and engineers claim to feel trapped, many express concerns that they “were being forced to decide between the Intel-led Open Internet Foundation (OCF) or Qualcomm’s AllSeen Alliance,” in much the same way as mobile developers are forced to prioritize either IoS or Android app development.

There are signs of change, however, the three primary commercial focused consortia are beginning to collaborate on common goals. In February, through a maze of announcements, strong signs emerged of a possible merger between the two major open source IoT frameworks, OCF and The AllSeen Alliance.

At first it appeared that Qualcomm might be willing to either let its AllJoyn middleware operate under the Intel led OCF umbrella, or to abandon AllJoyn entirely and move over to IoTivity. As it turns out, however, AllSeen subsequently released various statements to confirm that the AllSeen Alliance will continue to exist, but one of the main roles of the OCF will now be to create plug-ins for AllJoyn to connect to IoTivity.

In August, the Google-backed Thread Group announced that it is creating a liaison agreement with the Open Connectivity Foundation (OCF). The two organizations announced that they would "work together in their mission to advance the adoption of connected home products" and make their technologies "fully compatible."

Apple, on the other hand, have opted for a slightly different path, putting forward its own HomeKit standard in September 2014. Apple shows little interest in joining the discussion over standards for commercial building usage, as yet. In fact, it remains a mystery how HomeKit plans to interoperate with AllSeen, OIC or Thread.

The continued confusion surrounding the development no doubt slows the progression of this multi-billion dollar, revolutionary technological upheaval. However, through this natural course, questions are being answered and standards are being refined, creating a mature sector to identify the best route forward into a new, smart, connected world.

On this, our report suggest that, “while we are probably yet to hear the end of the story, for developers and IoT solutions providers, the fact that these major groupings are finally beginning to collaborate is a sign that the market is maturing, and these collaborations should be beneficial to the long-term overall growth of the IoT. In the end, what matters for users is that all devices work effortlessly and seamlessly with one another.”

[contact-form-7 id="3204" title="memoori-newsletter"]