LED Lighting may be the major driver for new growth in the world lighting controls business but unless the retrofit market can be opened up through an innovative awareness campaign and wireless technology the business will stagnate yet again in 5 years time.

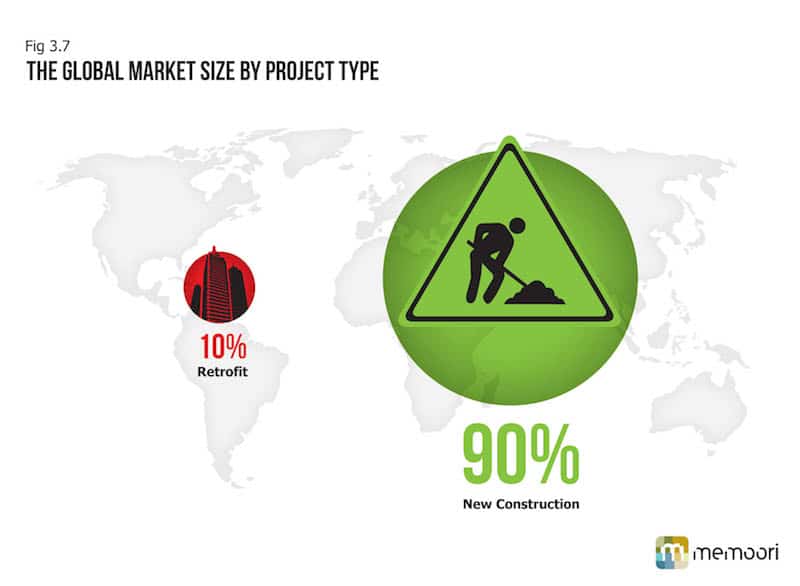

For the last 20 years the market for bus based lighting controls in non-domestic buildings has been dominated by new build & major refurbishment projects, taking some 90% by value and 80% by number of projects. Retrofit projects take the balance of 10%. As the attached chart shows in 2013 this has not changed despite the fact that new construction in developed countries accounts for no more than around 2 / 3% of the total population of buildings in the more buoyant years. The retrofit market therefore offers an enormous latent potential just waiting to be exploited. This is one of the major findings from our new report on lighting controls - Smart Buildings: The Lighting Controls Business 2013 to 2017

The failure to grow the retrofit business share despite significant increase in energy costs over the last 20 years and the fact that installing intelligent lighting is the most cost efficient means of reducing electrical consumption (which on average accounts for 25% of a buildings electricity use) can be attributed to a number of causes.

Recent research has shown that most building owners believe that it will take more than 5 years to get a full return on their investment (ROI) and would not consider anything more than 3 years. 3 years is a realistic time for ROI on medium to large buildings not taking into account any rebates or benefits derived from participating in demand response programmes and this could be reduced further if wireless control rather than wired control was used. The inconvenience and cost caused by running control wires is a serious barrier for retrofit applications.

Wireless technology until recently has been viewed skeptically by potential buyers, but a number of well respected lighting controls specialists have developed wireless controls and these have now proven that they can deliver a robust lighting control system. All the LED Lighting street controls that are now being installed in Europe use wireless. So with the benefit of wireless control the installation cost can be significantly reduced and by using Enterprise Energy Software further reductions in operating costs can be derived through providing value add services.

Opening up this Vast Latent Demand

The retrofit market has a massive latent potential available to be converted and could become larger than the new construction market within the next 5 years. However it will take time to get the industry organised to exploit it. During the next 2 years we expect it to increase its share and continue doing this until 2020.

What is needed now is an enlightened awareness campaign backed by government agencies to target building owners on the benefits of LED Lighting and its control. They are the ones that will have to make the investment decision and therefore the case for doing so has to be centred on what’s in it for them.

The UK’s largest retailer Tesco, according to their Director of Climate Change Helen Fleming said in 2012, “We benefit because we are becoming more energy efficient, and we’re saving money on our energy bills – we estimate that the actions we have taken since 2006 have saved us ‚£200 million pounds in energy bills on an annual basis.” This would have probably required an increase in annual sales of around ‚£4 Billion to have achieved the same number on the bottom line.

Interestingly this month a unique programme was announced by Tesco and the Carbon Trust that they have teamed up with environmental business community 2Degrees to launch a buying club that will encourage Tesco’s suppliers to invest in energy efficient lighting. The scheme aims to deliver savings to suppliers by taking advantage of collective purchasing power to buy energy efficient lighting equipment. Tesco came up with the idea for the scheme after it noticed there was interest among its suppliers in buying LEDs. Few companies around the world know more about how to buy at a competitive price so it’s good to know that that they are passing on this expertise and an excellent example of thinking outside the box.

Can government agencies come up with some innovative ideas on how to get owners and operators of buildings to invest in energy conservation? Would it be too avant-garde for them to say bulk buy advertising space for all those investing in conservation measures. Not to advertise their conservation exploits but the products and services they supply endorsed by some green credential. Could they measure this? Well they happily pay out billions to the media every year and many companies refuse to cut their budgets even during adverse trading conditions.

The timing looks just right for conservation to take a bigger share of the government’s budget to promote and assist the reduction of CO2 emissions. Capital intensive renewable power projects have taken the lion’s share of government’s time and budgets over the last 5 years; but in 2013 right, around the world, they are delaying their commitment to spend because of economic austerity and fear of political suicide if they allow electricity charges to go up.

We expect that in 2014 they will turn their attention again to how they can promote, assist and encourage energy conservation in order to achieve a low carbon economy in the 21st century. LED lighting and its control will be a major beneficiary as governments around the world are banning older, inefficient lighting technologies, and subsidising the retail price of LED lighting. By 2014, sales of incandescent bulbs will be restricted in virtually the entire developed world.

The supply side will also need to strengthen the channels of distribution and in some cases reconfigure them in order to open up the retrofit market. In most developed countries there are no shortages of electrical contractors that can take on the system integrator role but they will need training in the new lighting technologies and have a tactical sales strategy to identify, engage and convert potential customers.

More information can be found in our report - “Smart Buildings: The Lighting Controls Business 2013 to 2017”