This Research Note examines the emerging strategic priorities of Honeywell in the smart commercial buildings space. We have mapped M&A, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the company, by categorizing the various business relationships by technology and investment type over a 3-year period.

This article, Part 2 of a 2-part analysis (Part 1 is Here), is intended as a non-exhaustive indicator of the strategic direction of Honeywell Building Technologies (HBT) between January 2020 and October 2022.

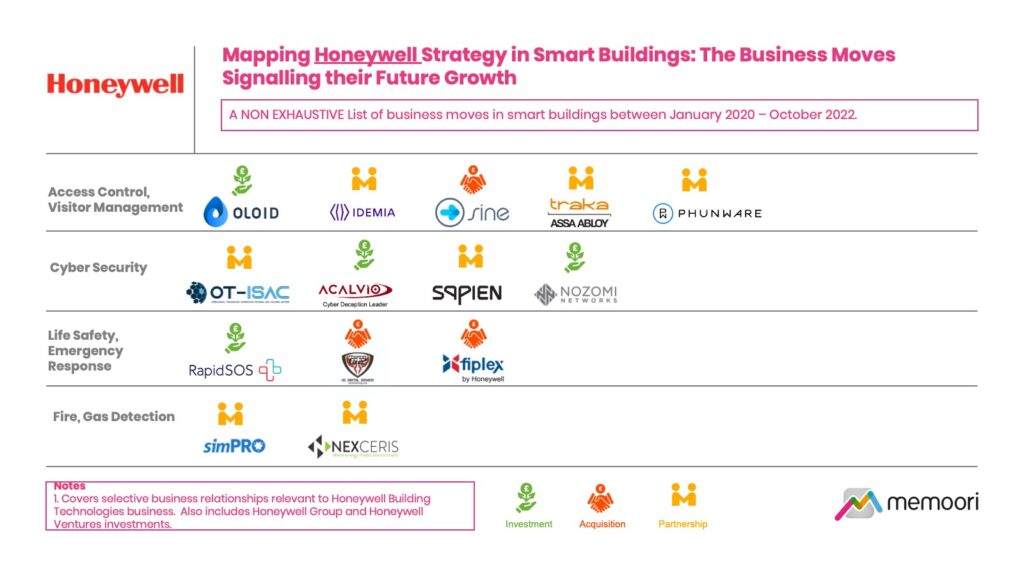

Our strategy mapping exercise highlights 16 partnerships, 3 acquisitions and 9 venture capital investments of relevance over the last three years for Honeywell in the smart buildings space.

We have covered key investments and partnerships in building management systems, in a previous post. This Research Note focuses on access control and visitor management, cyber security and a major growth initiative for HBT in the life safety and emergency response sectors.

Cyber Security

In January 2022, Honeywell and Acalvio launched a new solution designed to detect known and unknown (zero-day) attacks across the operational technology (OT) environments in commercial buildings. Honeywell Threat Defense Platform (HTDP) powered by Acalvio employs active defense – featuring autonomous deception tactics to outsmart attackers – and provides high fidelity threat detection. Honeywell’s relationship with Acalvio includes investment by Honeywell Ventures to further support the development of the latest cyber security solutions and disruptive technologies.

In November 2020, Honeywell and Nozomi Networks announced a cyber security partnership to deliver more comprehensive, end-to-end cyber security for Operational Technology (OT) environments. The partnership combines Nozomi Networks’ OT & Internet of Things (IoT) security and visibility capabilities with the strengths of Honeywell Forge Cybersecurity software, professional consulting and managed security services from Honeywell.

Life Safety & Emergency Response

In January 2022 Honeywell Building Technologies announced a strategic investment in RapidSOS, as well as technology integrations between the two companies that will further modernize and digitize the public safety communications process. RapidSOS is the emergency response data platform used by more than 5,200 emergency communications centers (ECCs) worldwide. The Honeywell Connected Life Safety System (CLSS) will link to the RapidSOS emergency response data platform to securely transmit detailed data about the emergency, such as the type of hazard, severity, and location within the impacted building to emergency response centers. The company participated in a further $75 million financing round in October 2022.

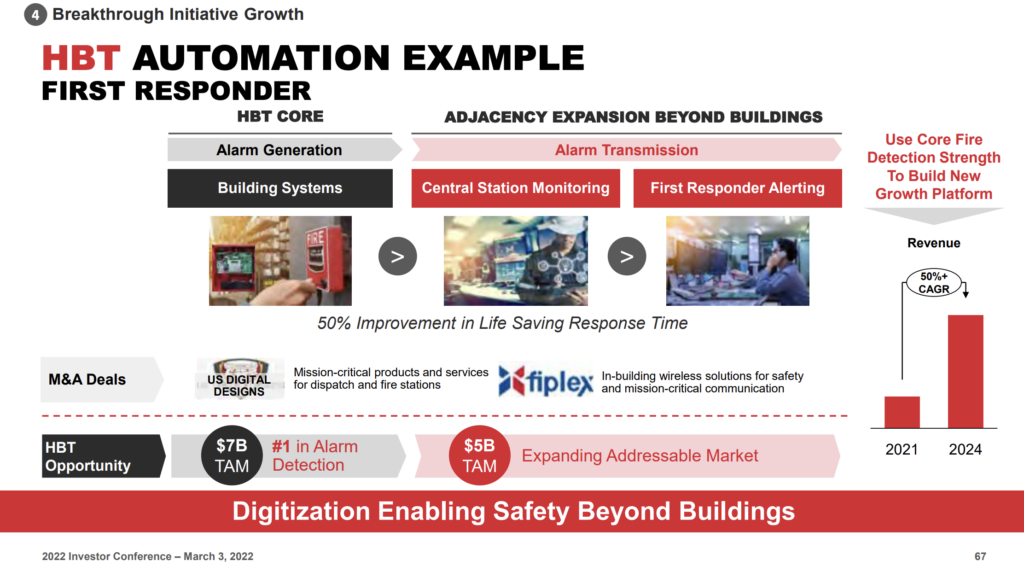

Honeywell announced in December 2021 that it had agreed to acquire privately held US Digital Designs Inc., for a purchase multiple of ~14X EBITDA in an all-cash transaction. The company delivers alerting and dispatch communications solutions, which enhance first responders' efficacy and enable faster emergency response times. The acquisition will be integrated into Honeywell's Fire and Connected Life Safety systems business and will expand Honeywell's line of solutions for public safety communications, providing first responders with better situational awareness of building emergencies and improved life safety.

Honeywell signed an agreement in March 2021 to acquire a majority stake in Fiplex Communications, Inc., a Miami-based company that develops in building communications systems, including bi-directional amplifiers (BDAs) that provide continuous and critical in-building radio coverage in challenging environments to improve the safety of first responders and building occupants.

These investments are part of the company's strategy to deploy capital to high-return acquisitions, which are aimed at driving future growth. One growth initiative to expand the core fire detection business into adjacent areas beyond buildings was described at the 3rd March 2022 Investor Conference.

Their strategy, as evidenced by the acquisitions and investments highlighted above, is to build a new growth platform based on alarm transmission and mission-critical communications to expand beyond their core fire detection addressable market into central station monitoring and fire responder alerting.

This initiative to modernize and digitize emergency communications infrastructure in the USA is targeting a 50%+ CAGR revenue growth between 2021 and 2024.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.