In this Research Note, we examine the Buildings business of Siemens, which operates within the Smart Infrastructure (SI) division, based on their Q4 press conference, earnings release, investor presentations of 17th November 2022 and building technology-related activities throughout the year.

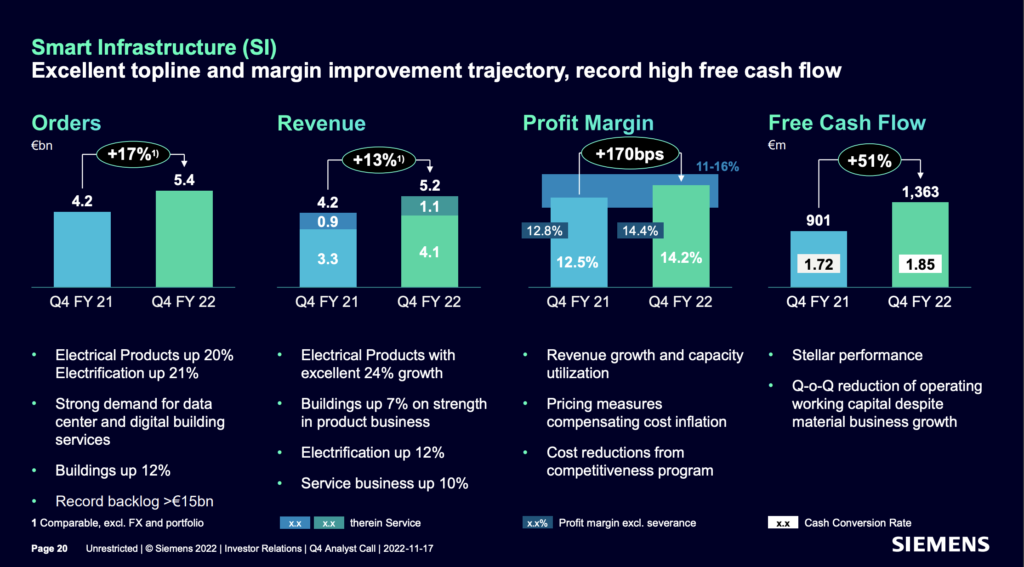

SI revenue growth is being led by strength in the Electrical Products business, which reported a 24% growth in Q4. While the Buildings business increased more modestly at 7%, driven by the product business. Smart Infrastructure achieved €17,353m revenues, year ending 30th September, 2022, a comparable revenue growth of 10% versus prior year and a 12.8% profit margin.

Their Buildings Business is the largest of 3 segments in the SI portfolio, accounting for 45% or €6.7 billion of FY 2021 revenues. The Buildings segment offers integrated building management systems and software, HVAC control products, fire safety/security products and systems and solutions and services, including energy and performance services. While Siemens does not report financials for its Buildings business, Memoori estimates that FY 2022 Buildings revenues are in the range of €7.0 to €7.5 billion.

The Electrical Products segment, accounting for 28% of FY 2021 revenues, includes low-voltage control products, distribution systems and switchgear, circuit breaker, contactors and switching for medium-voltage.

The Electrification segment, accounting for 27% of FY 2021 revenues, provides grid simulation, operation and control software, substation automation and protection, medium-voltage primary and secondary switchgear and eMobility charging infrastructure.

Digital Business which is defined as Siemens vertical specific software and IoT services across all businesses, achieved €6.5 billion revenues in fiscal 2022, a higher than expected 15% growth versus prior year. The majority of these revenues can be attributed to Siemens Digital Industries, the industrial automation business serving manufacturing and process industries, which is seeing a strong growth trajectory in the transition to Software as-a-Service (SaaS) revenues.

SI reported digital revenues of €700M in FY 2020 and is targeting a doubling of these revenues to €1.5 billion by FY 2025. Several software initiatives were announced in FY 2022, which are intended to accelerate the growth of digital business within SI.

The acquisition of Brightly Software, a US based provider of cloud-based SaaS for asset and maintenance management and for energy and sustainability management augments SI digital business to €880 million, without including any SaaS revenues generated elsewhere in the Buildings, Electrical Products or Electrification businesses.

The Buildings business of Siemens launched their new Building X smart buildings SaaS software suite, previously covered in our July Research Note. Their Xcelerator platform and marketplace, announced in parallel with Building X, is an ecosystem of technology partners bringing together hardware, software and digital services from Siemens’ various portfolios as well as a range of certified third parties in order to make digital transformation easier, faster and scalable.

The bolt-on acquisitions of French startup Wattsense and EcoDomus, a small US provider of BIM-based digital twin software for buildings, also expand their digital revenues and are covered in our previous article, Mapping the Strategic Direction of Siemens in Smart Buildings.

In summary, the Buildings business is predominately a hardware, installation and services player. With digital revenues accounting for an estimated 12% to 15% of the building technologies portfolio in 2022, Siemens has a long journey ahead to transform itself into a leading SaaS provider in the smart buildings space.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.