Founded in 1974, Systemair AB is a ventilation and air conditioning group with operations in more than 50 countries. The firm has reported an operating profit every year since its establishment and, over the past 10 years, the company’s average growth has averaged over 9%. In the 2021/22 financial year, Systemair achieved sales of SEK 9.6 billion ($918 million), the company’s best-ever annual financial results.

Headquartered in Skinnskatteberg, Sweden, Systemair shares have been quoted on the Nasdaq OMX Nordic Exchange in Stockholm since October 2007, and are today traded on the Large Cap List, which includes about 90 companies. The firm achieved its all-time highest share price of SEK 101.09 in December 2021, and after a dip that saw its share price drop to SEK 50 at points during the first three quarters of 2022, they finished the year around SEK 70 to 80 per share.

Systemair offers a wide range of energy-efficient fans, air handling units, air distribution products, air conditioning products and air curtains for all types of premises. The Group's products are marketed under several brands including Systemair, Frico, Fantech, and Menerga. The Group consists of 88 operating companies with more than 6,700 employees, across 52 countries, with 29 production facilities.

Over the course of the 2021-2022 financial year, their sales increased by 13.1% (to SEK 9.6bn) while operating profit improved by 10.6% (to SEK 770m). The company credit’s its ongoing efficiency measures for offsetting the increased costs, absences, and temporary closures caused by the significant challenges they faced over the period.

Systemair has a European focus. Over the 2021-2022 period, 62% of sales came from Northern and Western Europe, almost half of that from the Nordic region. Growth in European markets averaged around 10% providing a steady core market for the company. Eastern Europe and the CIS region made up a further 15% of total sales, providing a 17.4% growth rate despite impacts from the Russia-Ukraine war.

The Middle East, Asia, Australia, and Africa combined made up 12% of total sales during 2021-2022, presenting a strong growth rate of 16.7%. North and South America, meanwhile, represent 11% of total sales for 2021-2022 but present the highest regional growth rate of 19.4%, suggesting strong expansion opportunities for the company.

“Developments in North America have been highly positive. The USA and Canadian markets, in particular, have boomed in all our product segments, largely due to infrastructure investments. In particular, sales of air handling units for homes and schools have performed well. In our view, the outlook for North America also remains strong,” reads their 2021/2022 annual report.

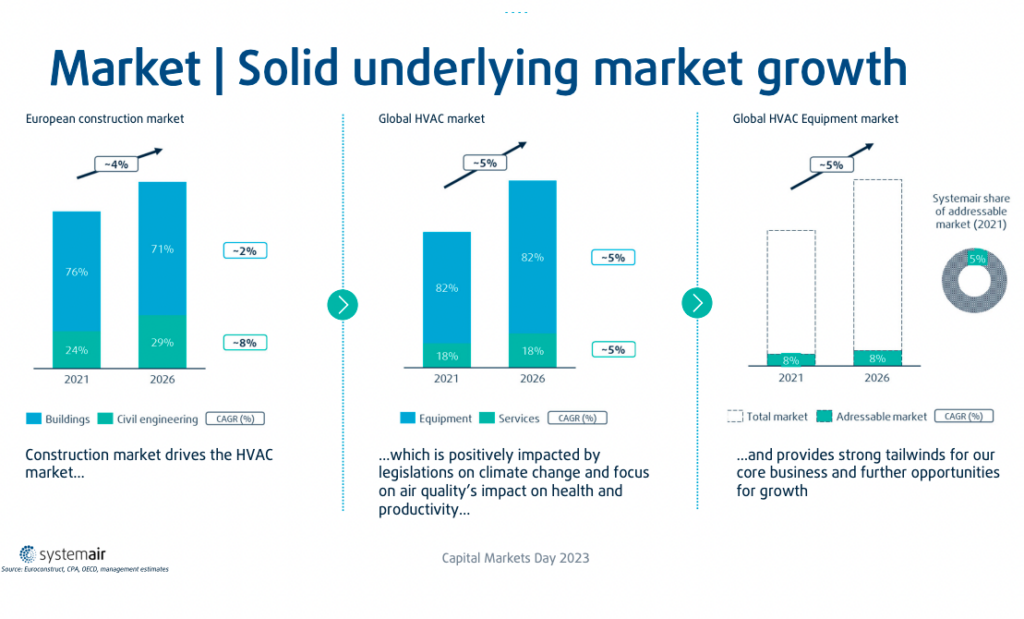

During their Capital Markets Day presentation last month, they estimated that the European Construction market will grow by 4% to 2026, driving growth of 5% in the HVAC market. They stated that renovation accounted for 49% of the European construction market in 2022 and that they are well-positioned for renovation and retrofit projects.

Systemair Acquisitions & Divestments

During the 2021-2022 period, Systemair acquired two Italian companies. In the first, in January 2022, Systemair acquired 80% of Tecnair LV S.p.A. from LU-VE Group for €15 million. Tecnair is an Italy-focused international supplier of indoor close-control air conditioning units primarily designed for hospitals and data centers.

Just over 2 months later, they acquired all shares in the Italian company SagiCofim S.p.A. for €33.6 million. SagiCofim has extensive experience in filtration and air distribution and their sales are dominated by the Italian market. SagiCofim has two divisions where approximately 60% of the business comprises the manufacture of air filters for healthcare facilities, the pharmaceutical industry, marine applications, and the energy sector.

Then, in November 2022, the firm entered into an agreement with Panasonic Corporation's Heating & Ventilation A/C Company intending to divest their air-conditioning business at an enterprise value of 100 million Euros on a cash and debt-free basis. The agreement includes the sale of all outstanding shares in Systemair S.r.l, and Tecnair S.p.A in Italy, and in due course the business conducted by the A/C sales employees of Systemair in Germany.

As the challenges of the pandemic diminish and they continue expansion into the North American market, we can expect more stable and strong growth from the company in the future. The impacts of the recent divestment of the firm’s A/C business to Panasonic are yet to be felt, but operating at significantly lower growth and profitability rates than Systemair’s core activities, it may well turn out to be a shrewd move to shed weight and refocus efforts on high potential opportunities.