The physical security business has outstripped the growth of the world economy for the last 5 years and Memoori forecasts that it will increase its rate of growth over the next 5 years, despite the fears of a global recession starting in 2020.

Demand has been built on the foundation that terrorism, crime, theft and safety must be controlled and physical security products are vital to ensure that this can be achieved. But more than that, the industry is now working hard to provide additional value to end users and creating further demand.

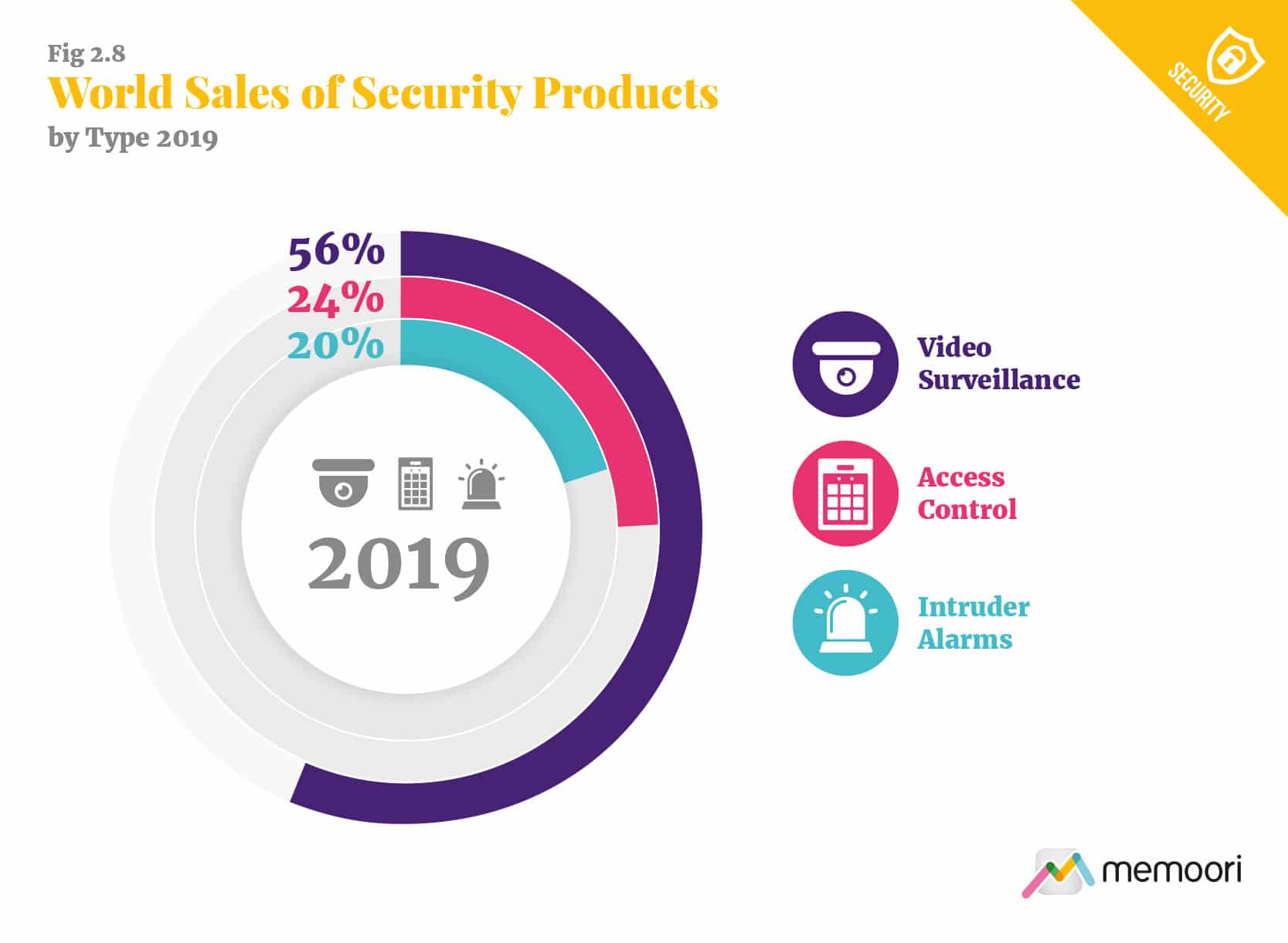

The total value of world production of Physical Security products at factory gate prices in 2019 was $34.31Bn, an increase of 8.5% on 2018 whist the compound annual growth over the last 5 years was 7.24%. However different rates of growth apply in each of the 3 businesses (Access Control, Video Surveillance & Intruder Alarm / Perimeter Protection) and geographic territories. We forecast the market will reach $56.76Bn by 2024 at a CAGR of 10.72%.

In 2019 Video Surveillance products at $19.25Bn had a share of 56% & Access Control at $8.08 billion a 24% share. This has been a stellar year for video surveillance thanks to growth in AI Video analytics software and VSaaS services.

The Chinese government has enforced barriers against imported Foreign AI and VSaaS imports and the US government have sanctioned Hikvision & Dahua (among others) for human rights abuses. These actions will have major implications in the Video Surveillance business but as western manufactures have never been accepted in the Chinese public sector market, this legislation could benefit them.

Access Control was expected to deliver a slightly higher performance than the 8.2% we estimate, as it further penetrated the IP Network business, advancing further into biometric, identity management, wireless locking systems and ACaaS and now contributing to the role of Building Occupancy Analytics.

The Intruder Alarm / Perimeter Protection market built up on the intruder alarms business and subseqently extended to the vertical market of Perimeter Protection by connecting radar, thermal and multi-sensor cameras. These integrations have all contributed to its growth.

There is an enormous latent demand waiting to be exploited in the emerging markets of the world. China for example currently has a penetration of only 50% of North America, based on sales per capita. This was only 14% in 2010. The Chinese market has grown rapidly through a boom in new construction and Safe City and Sharp Eyes projects in the public sector. However very little of this vast expanding market has so far been of benefit to overseas manufacturers.

In our new report, we forecast a CAGR of 10.7% in terms of value over the next 5 year period from 2019 to 2024. This average growth rate will be no mean feat, but some of this can be attributed to a relaxing in price pressures on video surveillance products. The main drivers over the next 5 years will be AI Video Analytics software and the Internet of Things business. This will be a recognized platform to open up more opportunities for security products and ACaaS and VSaaS will become mainstream.

Elsewhere in our report we outline the serious challenge that Privacy issues and Cyber threats represent, and how they will have a negative impact if not attended to. The report shows good reason to be optimistic about the future of the physical security industry as this year more new companies have entered the business and investment into physical security companies is the highest for 10 years.